It is common for companies to acquire another company or business. But the question is how do we know whether the acquisition constitutes a business combination? What does it mean by business combination? In this article, we will explore the financial reporting requirements for business combinations in IFRS 3 Business Combinations.

IFRS 3 was first issued in March 2004 to replace IAS 22 and three related interpretations. The International Accounting Standards Board (“IASB”), however, issued a revised IFRS 3 in January 2008. Preparers account for business combinations in accordance with the revised IFRS 3.

Although IFRS 3 is a complex standard, we are here to share on the key principles of the standard. For this, we divide this topic into 2 parts:

- Firstly, in Part I – we explore the definition of business combination. We also explore how entities determine whether the acquired set of activities and assets is a business combination.

- Secondly, Part II discusses the financial reporting requirements for a business combination.

Let us now go into the details of a business combination.

Scope of IFRS 3 Business Combinations

The standard does not apply for business combinations under common control. Business combination under common control is a combination where the same party ultimately controls all the combining entities, before and after the combination. In this situation, the control is not transitory.

To clarify, there is no other standards that govern the financial reporting for business combination under common control. Accordingly, entities develop its accounting policy on how to account for it. This topic nevertheless is currently in the pipeline of the IASB’s work plan – Business Combinations under Common Control.

Entities should not apply the principles in IFRS 3 to an acquisition by an investment entity. We have covered the financial reporting requirements for investment entities in Key Principles in the Preparation of Consolidated Financial Statements in IFRS 10.

What is a business combination?

An acquisition is a business combination when the assets acquired and liabilities assumed constitute a business. If an acquisition is not a business, an entity accounts it as an asset acquisition.

What is a business? IFRS 3 defines a business as “an integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing goods or services to customers, generating investment income (such as dividends or interest) or generating other income from ordinary activities.”

A business consists of inputs and processes applied to those inputs that have the ability to contribute to the creation of outputs. The three elements – input, processes and outputs – constitute a business. Entities need to determine and assess them to conclude whether the acquired set of activities and assets is a business. The standard refers this as “the full assessment approach.”

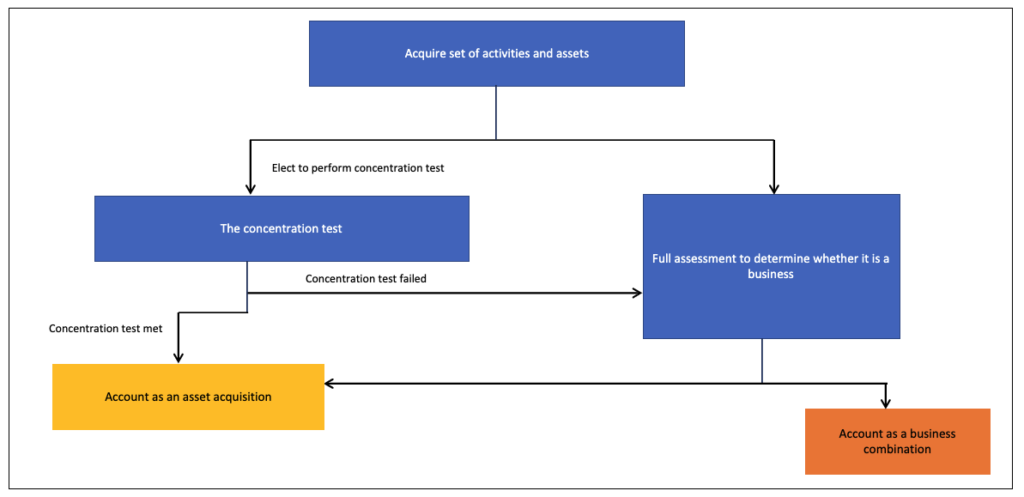

Alternatively, IFRS 3 introduces an optional test. It requires entities to identify the concentration of fair value (“the concentration test”) in determining a business combination. Entities can make this election separately for each transaction or other event.

Let us now explore the full assessment approach and the concentration test in determining a business combination.

The concentration test

The concentration test simplifies an entity’s assessment of whether an acquired set of activities and assets is a business. If the concentration test is met, the acquired set of activities and assets is not a business. However, if an entity failed the test, or elects not to apply the test, it must perform the full assessment to determine whether the acquisition is a business.

Assessing the concentration test

What is the concentration test? An entity performs this test to assess the concentration of fair value of the acquired set of activities and assets. The concentration test is met if substantially all of the fair value of the gross assets acquired is concentrated in a single or a group of similar identifiable asset.

Under the concentration test, entities must observe the following:

- Firstly, gross assets acquired — Exclude cash and cash equivalents, deferred tax assets and goodwill resulting from the effects of deferred tax liabilities.

- Secondly, the fair value of the gross assets acquired – Include any consideration transferred, including the fair value of any non-controlling interest and the fair value of any previously held interest in excess of the fair value of net identifiable assets acquired.

- Thirdly, single identifiable asset – Include any asset or group of assets that would be recognised and measured as a single identifiable asset in a business combination.

- Fourthly, tangible asset – A tangible asset that is attached to and cannot be physically removed and used separately from another tangible asset without incurring significant costs or diminution is utility or fair value to either asset, those assets are considered as a single identifiable asset.

- Lastly, similar assets — Entities should consider the nature of each single identifiable asset and the risk associated with managing and creating outputs from the assets.

The full assessment

We mentioned earlier that a business consists of three elements – input, processes and output. Under the full assessment approach, entities need to assess the three elements. The table below explains these elements:

| Input | Process | Output |

|---|---|---|

| Any economic resource that creates outputs or has the ability to contribute to the creation of outputs, when one or more processes are applied to it. | Any system, standard, protocol, convention or rule that when applied to input(s), create outputs or has the ability to contribute to the creation of outputs. A process includes strategic management processes, operational processes and resource management processes. Although these processes are documented, the intellectual capacity of an organised workforce having the necessary skills and experience following rules and conventions may provide the necessary processes that are capable of being applied to inputs to create outputs. | Output is the result of inputs and processes applied to those inputs that provide goods or services to customers, generate investment income or generate other income from ordinary activities. |

IFRS 3 further clarifies that outputs are not required to qualify as a business. It is common for an acquired set of activities and assets not to have outputs. For example, an early-stage entity which is yet to generate revenue.

Substantive process

The two essential elements of a business are inputs and processes. It is not necessary to include all of the inputs or processes that the seller used in operating that business. Importantly, the process must be a substantive process so that both an input and the substantive process, together, significantly contribute to the ability to create output. In fact, if a set of activities and assets acquired has outputs, continuation of revenue does not on its own indicate the acquisition of both an input and a substantive process.

Depending on whether a set of activities and assets have outputs or not at the acquisition date, an acquired process is a substantive process when:

| A set of activities and assets does not have outputs at the acquisition date | A set of activities and assets has outputs at the acquisition date |

|---|---|

| – It is critical to the ability to develop or convert and acquired input(s) into outputs; and – The inputs acquired include both an organised workforce that has the necessary skills, knowledge or experience to perform the process and other inputs that the organised workforce could develop or convert into outputs. | – Is critical to the ability to continue producing outputs, and the inputs acquired include an organised workforce with the necessary skills, knowledge or experience to perform that process; or – Significantly contributes to the ability to continue producing outputs and is considered unique or scarce or cannot be replaced without significant cost, effort or delay in the ability to continue producing outputs. |

Conclusion

The above summarises the key principles in determining a business combination. In our Part II, we explain on how entities account for business combinations.

Stay tuned for our upcoming articles by following us on social media. Meantime, enjoy other articles in Financial Accounting section or ask your queries by Joining on Community. It is free and open to join for all now.