The Malaysian Accounting Standards Board (“MASB”) had on 5 June 2020 issued amendments to MFRS 116 Property, Plant and Equipment. The amendments is in relation to the proceeds received by an entity before the intended use of an asset. The amendments will be effective for financial period beginning on or after 1 January 2022. MASB however, allows for entities to apply the amendments earlier than the effective date.

Take note that the Malaysian Financial Reporting Standards (“MFRS”) is equivalent to the International Financial Reporting Standards (“IFRS”). This is following the convergence initiative by Malaysia. IFRS is issued by the International Accounting Standards Board (“IASB”).

Let’s now understand the amendments.

The current requirements on proceeds before intended use of property, plant and equipment

Paragraph 17(e) of MFRS 116 requires an entity to deduct the net proceeds from selling any items produced before the intended use from the cost of the property, plant and equipment. The paragraph provides an example of samples produced when testing equipment.

IASB however noted that there are different practices on how entities deduct the proceeds from the cost. IASB noted that:

- Some entities deduct only proceeds from selling items produced while testing

- Other entities deduct proceeds of all sales until an asset is capable to operate as intended by management.

In addition, for some entities, the proceeds deducted from the cost could be significant and exceed the cost of testing. Hence, IASB decided to clarify this matter through the amendments.

The amendments on proceeds before intended use of an item of property, plant and equipment

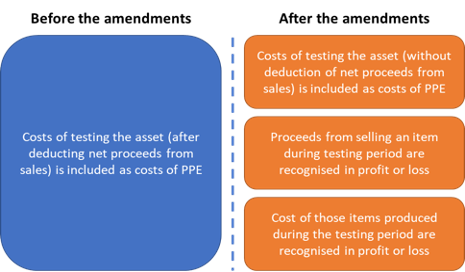

The diagram below provides the high-level overview of the main changes under the amendments:

Under the new amendments, an entity can no longer include net proceeds from selling of testing items as part of its costs of property, plant and equipment.

Entities will now realise that the amount capitalised as the cost of asset is rather limited after the amendments. It is limited to the costs of testing the asset before its intended use by management. In fact, the profit or loss will now need to recognise immediately the proceeds from selling an item produced during the testing period, together with the necessary cost of producing those items.

IASB believe that entities need to recognise the proceeds and the related costs in profit or loss because they meet the definition of income and expenses. Accordingly, recognising the two in profit or loss will better reflect the company’s performance for the period.

The new amendments also require an entity to disclose:

- the amount of proceeds and costs included in profit or loss

- the line item(s) in the statement of comprehensive income include(s) such proceeds and costs. This disclosure is necessary if entities do not present such amount separately in the statement of comprehensive income.

The challenges of applying the amendments

We expect entities to face with the following challenges in applying the amendments:

#1: Retrospective application of the amendments

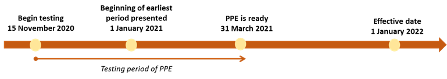

Entities must apply the amendments retrospectively. This means, entities will need to restate the comparative numbers. However, the retrospective application is rather limited in the amendments. Entities apply the restropective application to items of property, plant and equipment that are ready for its intended use by management on or after the beginning of the earliest period presented in which an entity first applies the amendments. The timeline below illustrates how entities apply the retrospective application, assuming an entity applies the amendments when it becomes effective.

Using the example of the timeline above, since the PPE asset is ready for its intended use by management post-1 January 2021 (i.e., on 31 March 2021), entities will need to restate the retained earnings on 1 January 2021 to reflect the impact of the amendments. Entities recognise any proceeds and cost of an item produced during the testing period beginning 15 November 2020 in profit or loss.

#2: Distinguish between cost of producing and selling of an item

Companies may also encounter difficulty to distinguish between the costs related to producing and selling an item before the property, plant and equipment is ready for intended use by management and the costs related to preparing the asset itself.

This is the case for most companies that did not keep track and properly determine and account for the costs of the two previously. Entities also need to apply judgement to distinguish these two costs moving forward.

To better prepare for the application of the amendments when it becomes effective, early planning and gathering of information required are necessary at this juncture. In fact, since the effective date is in few months time, you will need to start look at the amendments soon.

The full version of the amendments is available at Notice of Issuance/Amendments on the MASB website.