In the current economy, it is common for companies to conduct their business activities or enter into business transactions in other foreign jurisdictions or even have foreign operations. IAS 21 The Effects of Changes in Foreign Exchange Rates addresses the financial reporting requirements specifically on how to account the effects arising from foreign currency transactions and foreign operations in the financial statements of an entity. The standard also provides the procedures on how entities translate their financial results and statement of financial position prepared in functional currency into a presentation currency. The complexity revolves around the issues of determining the exchange rate(s) to be used and how to report such effects in the financial statements.

Let’s now understand the key requirements of IAS 21.

The concept of functional currency and presentation currency

When we discuss foreign exchange rates – the ratios of exchange for two currencies, it relates to transactions in foreign currencies. For the purpose of applying the standard, foreign currency is defined as a currency other than the functional currency of the entity. This is where the concept of functional currency is introduced. What is functional currency? Is it the currency that the entity use to transact with other parties in a foreign jurisdiction? How does it differ from presentation currency? Let’s see these 2 concepts:

| Functional currency | Presentation currency |

|---|---|

| The currency of the primary economic environment in which the entity operates. | The currency in which the financial statements are presented. |

For some entities, their functional currency is the same as the presentation currency. But this may not be the case for others. IAS 21 allows or permits the presentation currency to be any currency and this is very much driven by the local laws and regulations on the preparation and submission of the financial statements.

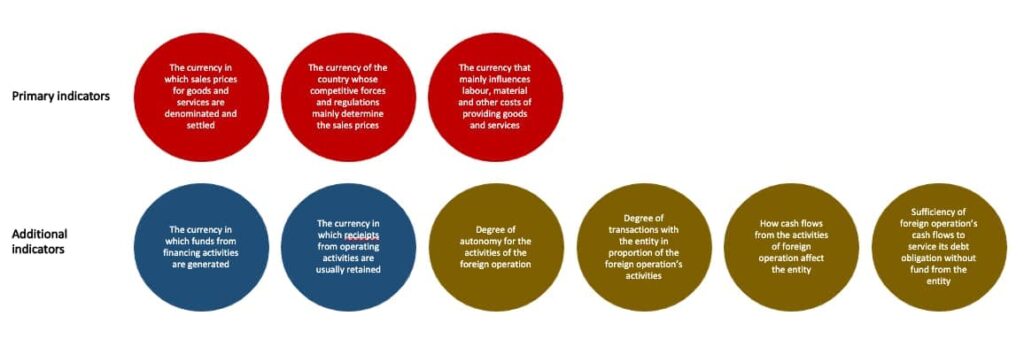

Next question is then, how do we determine ‘the primary economic environment’ of the entity? The primary economic environment is the economic environment where it primarily generates and expends cash. IAS 21 requires entities to consider the following factors in determining their functional currency:

- the currency:

- that mainly influence sales prices for goods and services – often be the currency in which sales prices for its goods and services are denominated and settled.

- of the country whose competitive forces and regulations mainly determine the sales prices of its goods and services.

- the currency that mainly influences labour, material and other costs of providing goods or services – often be the currency in which such costs are denominated and settled.

These factors are the primary factors or indicators in determining the functional currency.

IAS 21 further states that the factors below may also provide evidence of the entity’s functional currency:

- The currency in which funds from financing activities are generated.

- The currency in which receipts from operating activities are usually retained.

In determining the functional currency of a foreign operation and whether its functional currency is the same as that of the reporting entity, the additional factors below are to be considered:

- whether the activities of the foreign operation are carried out as an extension of the reporting entity rather than being carried out with a significant degree of autonomy.

- whether transactions with the reporting entity are a high or a low proportion of the foreign operation’s activities.

- whether cash flows from the activities of the foreign operation directly affect the cash flows of the reporting entity and are readily available for remittance to it.

- whether cash flows from the activities of the foreign operation are sufficient to service existing and normally expected debt obligation without funds being made available by the reporting entity

It is possible for entities to get mixed indicators and hence, the functional currency is not clear. What should an entity do in this situation? In such a situation, IAS 21 requires management to use its judgement to determine the functional currency that most faithfully represents the economic effects of the underlying transactions, events and conditions. For this, the standard further states that management must give priority to the primary indicators before considering the additional 6 factors above as they are intended to provide additional supporting evidence to determine an entity’s functional currency. So, once the functional currency is determined, it is not expected to change unless there is a change in those underlying transactions, events and conditions.

Take note that if the functional currency is the currency of a hyperinflationary economy, the entity’s financial statements must be restated in accordance with IAS 29 Financial Reporting in Hyperinflationary Economies. We have covered the discussion on the procedures in 10 key takeaways on IAS 29 Financial Reporting in Hyperinflationary Economies.

What is a foreign currency translation?

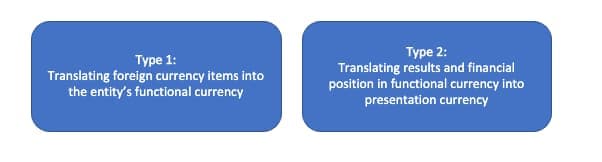

Each entity is required to determine its functional currency as explain in the earlier section of this article. After determining the functional currency, entities will then need to translate foreign currency items into their functional currencies and report the effect of such translations. In addition to translating foreign currency items into its functional currency, some entities may also need to report their financial results and financial position in a presentation currency that is different from its functional currency. For instance where an entity that has USD functional currency needs to report to its parent company which uses Ringgit Malaysia (“RM”) presentation currency.

IAS 21 governs the translation requirements for financial reporting purpose in both situations. Let’s now look at the key requirements for both.

Reporting foreign currency transactions in the functional currency

A foreign currency transaction is a transaction that is denominated or requires settlement in foreign currency. On its initial recognition, IAS 21 requires such transaction to be recorded at the spot exchange rate at the date of the transaction – i.e., the date the transaction first qualifies for recognition in accordance with IFRSs. For this purpose, entities may use the average rate for a week or a month for that period for practicality, unless if the exchange rates fluctuate significantly.

After its initial recognition, entities will need to perform the following at the end of each reporting period:

- Translate foreign currency monetary items using the closing rate (spot exchange rate at the end of the reporting period);

- For non-monetary items:

- Those that are measured in terms of historical cost should be translated using the exchange rate at the date of the transaction.

- Those that are measured at fair value should be translated using the exchange rates at the date when the fair value was measured.

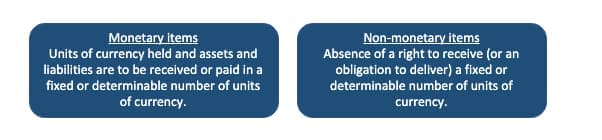

This is where the concept of monetary and non-monetary items are then introduced.

Examples of monetary items are lease liabilities, receivables, provisions that are to be settled in cash and others while examples of non-monetary items are amounts prepaid for goods and services, goodwill, inventories, intangible assets and others.

Exchange differences arising on the settlement of monetary items or on translating monetary items at rates different from the translation on initial recognition during the period or in the previous financial statements shall be recognised in profit or loss in the period in which they arise. Exception however applies for a monetary item that forms part of the entity’s net investment in a foreign operation. This will be explained in the later part of this article.

Take note, however, when the transaction for a monetary item is settled in a subsequent reporting period from the period it occurred, the exchange difference recognised in profit or loss is determined by the change in exchange rates during each period. Also, any exchange component arising from a gain or loss on a non-monetary item follows where such gain or loss on the item is recognised. This means, when a gain or loss on a non-monetary item is recognised in profit or loss, any exchange components of that gain is also recognised in profit or loss. The same applies if the gain or loss is recognised in other comprehensive income.

Translation of functional currency into a presentation currency

IAS 21 stipulates the following procedures for entities to follow when translating their results and financial position in functional currency (only for currency in a non-hyperinflationary economy) to a different presentation currency:

- Assets and liabilities for each statement of financial position presented, including comparatives, are translated at the closing rate at the date of that statement of financial position;

- Income and expenses, including comparatives, are translated at exchange rates at the date of the transactions; and

- All resulting exchange differences are recognised in other comprehensive income.

For practical reason, IAS 21 also allows entities to use a rate that approximates the exchange rates at the dates of the transactions such as an average exchange rate for the period, to translate income and expense items, unless the exchange rates fluctuate significantly.

Foreign Operation

Foreign operation is an entity that is a subsidiary, associates, joint arrangement or branch of a reporting entity, the activities of which are based or conducted in a country or currency other than those of the reporting entity. A reporting entity may have a monetary item that is receivable from or payable to a foreign operation such as long-term loans or receivables. Where the settlement of the monetary item is neither planned nor likely to occur in the foreseeable future, it is in substance, a part of the entity’s net investments in that foreign operation. Net investment in a foreign operation is the reporting entity’s interest in the net assets of that operation.

Exchange differences on a monetary item that forms part of the entity’s net investment in a foreign operation are recognised in profit or loss in the separate financial statements of the entity or the individual financial statements of the foreign operation. However, in the consolidated financial statements, the exchange differences are recognised initially in other comprehensive income and reclassified to profit or loss on disposal of the net investment.

For this, on disposal of a foreign operation, the cumulative amount of the exchange differences relating to the foreign operation accumulated in the separate component of equity (commonly labelled as foreign currency reserves in the financial statements) are reclassified to profit or loss when the gain or loss on disposal is recognised.

On the partial disposal of a subsidiary that includes a foreign operation, an entity needs to re-attribute the proportionate share of the cumulative amount of the exchange differences to the non-controlling interests in that foreign operation. In any other partial disposal of a foreign operation, an entity will need to reclassify to profit or loss only the proportionate share of the cumulative amount of the exchange differences recognised in other comprehensive income.

The above summarises the key financial reporting requirements in IAS 21. We hope readers now understand the financial accounting requirements on the effects of changes in foreign currency rates.

Stay tuned for our upcoming articles by following us on social media. Meantime, enjoy other articles in Financial Accounting section or ask your queries by Joining us on Community. It is free and open to join for all, now.