In this article, we continue to discuss about the preparation of financial statements. But this time, it will be the preparation and presentation of consolidated financial statements in IFRS 10.

IFRS 10 Consolidated Financial Statements governs the accounting requirements for the preparation of consolidated financial statements (or commonly known as “group account”). Not sure what is consolidated financial statements? We got this covered in Preparation of separate financial statements under IAS 27.

IFRS 10 stipulates the following:

- An entity that is a parent that controls one or more of subsidiaries must present consolidated financial statements.

- The principle of control and establishes control as the basis for consolidation.

- The requirements on how to apply the principle of control.

- The requirements on the preparation of consolidated financial statements.

- Definition of an investment entity and exception to consolidation for particular subsidiaries of an investment entity.

Let’s now go deeper to understand these requirements.

Presentation of consolidated financial statements

As a general rule, all parents that control its subsidiaries must present consolidated financial statements. A parent, however, does not need to present consolidated financial statements if it meets all of the following conditions:

- The parent is a wholly-owned subsidiary or is a partially-owned subsidiary of another entity and all its other owners, including those not otherwise entitled to vote, (a) have been informed about and (b) do not object to, the parent not presenting consolidated financial statements;

- Its debt or equity instruments are not traded in a public market;

- It did not file, nor is it in the process of filing, its financial statements with a securities commission or other regulatory organisation for the purpose of issuing any class of instruments in a public market; and

- Its ultimate or any intermediate parent produces financial statements that are available for public use and comply with the International Financial Reporting Standards (“IFRSs”), in which subsidiaries are consolidated or are measured at fair value through profit or loss.

Consolidation exception

Nevertheless, in Malaysia, an ultimate Malaysian parent entity must present consolidated financial statements, irregardless of meeting the criteria above. This means, although an ultimate Malaysian parent entity may have another parent in foreign jurisdiction which prepares a consolidated financial statements, the ultimate Malaysian parent must still prepare the consolidated financial statements.

Additionally, the consolidation exception is applicable for a parent that is an investment entity. An investment entity parent entity does not need to present consolidated financial statements if, it is required to measure all of its subsidiaries at fair value through profit or loss. Further discussion on this is available in the investment entity section below.

The control determination and assessment

IFRS 10 only requires a parent to consolidate the subsidiaries that it controls. The next question is then what is control? How do we know if a parent controls its subsidiaries? Do we only look at the ownership interest? Can we assume a parent with ownership voting interests of more than half (>50% voting rights) controls the subsidiaries?

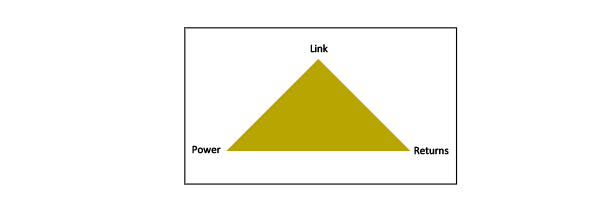

An investor controls an investee when it is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee. Accordingly, for an investor to control an investee, it must have the three control elements:

- Power over the investee

- Exposure/right to variable return from its involvement with the investee

- The ability to use its power over the investee to affect the amount of the its returns.

When assessing control, the entity should consider all facts and circumstances. Entities will only reassess this if facts and circumstances indicate changes to one or more of the elements.

a) Power

An entity has power over an investee when it has existing rights that give it the current ability to direct the relevant activities of the investee. This requires an investor to determine what are the relavant activities of the investee – i.e., activities that significantly affect the investee’s returns. IFRS 10 provides examples of activities that, depending on circumstances, can be relevant activities. For examples, selling and purchasing of goods and services, selecting, acquiring or disposing of assets, determining funding structure or obtaining funding and others.

Power and right

Power arises from rights. In assessing the rights that an investor have, such rights must be substantive rights. A substantive right means the holder has the practical ability to exercise that right. This essentially requires entities to exercise judgments. Sometimes, rights can also be substantive even though they are not currently exercisable.

It is also important for entities to be able to differentiate between substantive right and protective right. Protective rights relate to fundamental changes to the activities of the investee or are only apply in exceptional circumstances. The purpose of a Protective right is mainly to protect the interests of its holder without giving the holder power over the investee.

Right is generally obtained from the voting rights, although this is not always the case. Assessing whether an investor has power can be complex in certain scenarios. Entities need to carefully consider the facts and circumstances. For example when power arising from one or more contractual arrangements.

Generally, an investor that holds more than half of the voting rights has the power over the investee, if, the relevant activities are directed by a vote of the holder of the majority of the voting rights or a mojority of the members of the governing body that directs the relevant activities are appointed by a vote of the holder of the majority of the voting rights.

Importantly, the voting rights must be substantive – an investor does not have power over an investee even though it holds the majority of the voting rights when those voting rights are not substantive. In contrast, an investor can also have a power even if it holds less than a majority of the voting rights of an investee.

b) Returns

An investor must also have exposure to variable returns from its involvement with the investee. This means the investor’s exposure varies as the result of the investee’s performance – i.e., returns from the investee can be only positive, only negative or both negative and positive. Examples of returns include dividends, other distribution of economic benefits from an investee, remuneration for servicing an investee’s assets and liabilities, fees and exposure to loss from providing credit or liquidity support and returns that are not available to other interest holders.

c) Link between power and returns

For an investor to control an investee, the investor must have the ability to use its power to affect the investor’s returns from its involvement with the investee. For this, an investor with decision-making rights must determine whether it is a principal or an agent. An agent is a party primarily engaged to act on behalf and for the benefit of another party. Therefore does not control the investee when it exercises its decision-making authority.

Entity need to exercise judgements to establish what kind of decision-making right that it has on the investee, including:

- the scope of its decision-making authority.

- the rights held by other parties.

- the remuneration to which it is entitled.

- the decision maker’s exposure to variability of returns from other interests it holds in the investee.

Preparation of consolidated financial statements

For the preparation of consolidated financial statements, entities must observe the following requirements:

1. Accounting policies

IFRS 10 requires a member of the group to apply uniform accounting policies for similar transactions and other events in similar circumstances. If any of the member uses different accounting policies, entities must make the appropriate adjustments to ensure conformity with the group’s accounting policies.

2. The start and the end of consolidation

An investor starts consolidating an investee from the date the investor obtains control of the investee and stops consolidating when it loses control over it.

3. Consolidation procedures

An investor should consolidate an investee by:

- Combine like items of assets, liabilities, equity, income, expenses and cash flows of the investor with those of its subsidiaries.

- Eliminate the carrying amount of the parent’s investment in each subsidiary and the parent’s portion of equity of each subsidiary.

- Eliminate in full intragroup assets and liabilities, equity, income, expenses and cash flows relating to transactions between entities of the group. Entities should also consider the effects for temporary differences.

4. Reporting date

The financial statements of the parent and its subsidiaries used in the preparation of the consolidated financial statements must have the same reporting date. If subsidiaries have different reporting dates from the parent, additional information and adjustments are required for consolidation purposes. The difference between the date of the subsidiary’s financial statements and that of the consolidated financial statements must not be more than 3 months. The length of reporting period should also be the same.

5. Non-controlling interests (“NCIs”)

Entities must present NCIs within equity, separately from equity of the owners of the parent. Profit or loss and each component of other comprehensive income must be attributed or apportioned between the owners of the parent and NCIs. When there is a change in a parent’s ownership interest that do not result in loss of control, the effects are equity transactions.

6. Loss of control

When a parent loses control of a subsidiary, it:

- derecognises the assets, and liabilities of the subsidiary from its consolidated statement of financial position;

- recognises any investment retained in the former subsidiary at its fair value and subsequently accounts for it in accordance with the relevant IFRSs; and

- recognises the gain or loss arising from the loss of control.

Investment entity

IFRS 10 defines an investment entity as an entity that:

- obtains funds from one or more investors for the purpose of providing those investors with investment management services;

- commits to its investors that its business purpose is to invest funds solely for returns from capital appreciation, investment income or both; and

- measures and evaluates the performance of substantially all of the investments on a fair value basis.

IFRS 10 also provides the typical characteristics of an investment entity. An investment entity that does not have all of the typical characteristics must provide additional disclosures required by IFRS 12 Disclosure of Interest in Other Entities. Any changes to the typical characteristics or the definition of investment entity would require a parent to re-assess whether it is an investment entity.

IFRS 10 states that an investment entity should not consolidate its subsidiaries, instead should measure its investments in subsidiaries at fair value through profit or loss. However, if an investment entity has a subsidiary that is not itself an investment entity and whose main purpose and activities are providing services that relate to the investment entity’s investment activities, entities must consolidate such subsidiary. This constitues an exception to the mandatory requirements to fair value investments of an investment entity.

It is important to note that a parent of an investment entity must consolidate all entities that it controls including those controlled through an investment entity subsidiary. Exception applies only if the parent itself is an investment entity.

Conclusion

IFRS 10 is in fact a complex and comprehensive standard. It requires entities to apply lots of judgments in applying the principles. Nevertheless, we hope you now understand the key principles stated in the standard from this article.

We will bring you more technical discussion in our upcoming articles. Stay tuned for our upcoming articles by following us on social media. Meantime, enjoy other articles in Financial Accounting section or ask your queries by Joining on Community. It is free and open to join for all, now.