The International Accounting Standards Board (“IASB”) issued an Exposure Draft: Disclosure Requirements in IFRS Standards – A Pilot Approach on 25 March 2021 to gather public feedback on the IASB’s proposed approach to address the long-outstanding challenges surrounding the disclosure of information in the financial statements.

The primary users of the financial statements often struggle to find useful information specific to the entity, beyond the checklist compliance kind of disclosure. Often time, information disclosed in the financial statements is either too little, too much (information included are irrelevant) or information not disclosed effectively (mere compliance, boilerplate and less entity specific to meet the disclosure objectives). As such, the IASB has issued this exposure draft with the aim to address these concerns.

About the proposed guidance to disclosure requirements in IFRS Standards

The exposure draft aims at informing the stakeholders on the proposed guidance (or guiding principle) to be taken by the IASB in developing and drafting disclosure requirements in individual IFRS standards in the future. To test the proposed guidance, the IASB uses two standards – IFRS 13 Fair Value Measurement and IAS 19 Employee Benefits as the pilot standards on how the disclosure requirements in these 2 standards will look like using the proposed guidance and as for the area of improvement of the proposed guidance. For the purpose of this article, we will not discuss further the proposed changes made to the two standards.

The proposed guidance discusses three types of disclosure objectives which are:

- Overall disclosure objectives;

- Specific disclosure objectives; and

- Items of information to meet specific disclosure objectives.

The three types of disclosures objectives above are explained further below.

In achieving the intended outcome of the approach, the Board intends to:

- Use the prescriptive language “shall” to denotes mandatory disclosure objectives that entities need to comply; and

- Use of less prescriptive language when referring to items of information – specifically to state “while not mandatory, the following information may enable an entity to meet the disclosure objectives”.

The Board also does not intend to make any reference to materiality as materiality should always be the overarching concept when entities apply the standards – the standards do not apply to immaterial information, including disclosure requirements. We have covered the discussion on materiality in 10 key takeaways on the Practice Statement 2, Making Materiality Judgements.

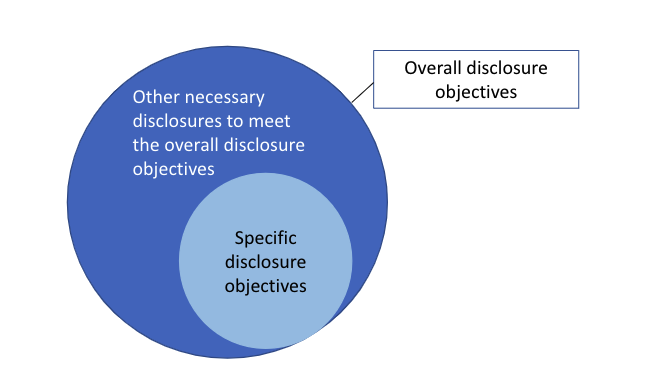

The overall disclosure objectives

The ‘overall disclosure objectives’ describe the overall information needs of the users of the financial statements. Entities must assess whether the notes included in the financial statements to achieve specific disclosure objectives meet the overall user information needs. If they are not, entities consider additional information to be disclosed in order to meet the overall disclosure objectives. This means additional disclosures are required beyond the information required by the specific disclosure objectives.

Specific disclosure objectives

Specific disclosure objectives outline the detailed information needs of the users of the financial statements. To comply with the specific disclosure objectives, entities will need to disclose all material information that is required to achieve or meet the specific disclosure objectives. Entities are expected to apply professional judgement effectively in order to decide what information and whether the information provided is sufficient to meet detailed user information needs. The Board proposed to include explanatory paragraph(s) to explain what and how the information provided will help users of the financial statements – for example, it helps users to perform a particular analysis, assessment or evaluation. In doing this, IASB will also strike a balance for entities to disclose entity-specific information with the information needed for comparison across entities. This is consistent with the very fundamental objective of the financial reporting framework which is to allow users to compare the performance of one entity to another. We have covered this fundamental in Objectives and users of the general purpose financial statements.

Items of information to meet specific disclosure objectives

This reflects the list of items of information that entities may, or is required to disclose to meet the specific disclosure objectives. What the IASB intends to do is to link every item of information in the disclosure section to the specific disclosure objectives. This aims at assisting entities to make the judgement effectively about whether the information is material and needs to be disclosed, including how to satisfy the specific disclosure objectives. Where particular information is always needed or required by the users, the Board will first develop a disclosure objective that is specific enough to make clear what information would satisfy the objective. However, if such an approach is not possible, the IASB will use the prescriptive language to require disclosure of a particular item of information and explain why the item is essential in the Basis of Conclusions.

The Exposure Draft: Disclosure Requirements in IFRS Standards – A Pilot Approach is open for public comments until 21 October 2021. The exposure draft also illustrates how the proposed guidance is applied in IFRS 13 and IAS 19. While we provide more updates to you, in the meantime, you can read various related articles in the Financial Accounting section.