The Malaysian Public Sector Accounting Standards, or MPSAS is the financial reporting framework issued by the Accountant General’s Department (“AGD”) of Malaysia.

In this article, we share with you an overview of MPSAS.

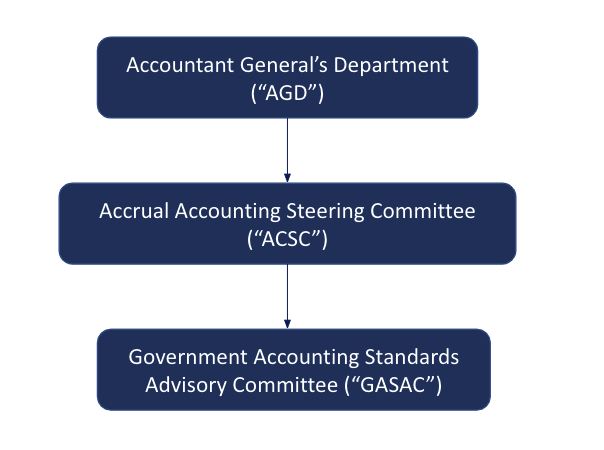

The governance structure of MPSAS

AGD of Malaysia has established two committees – the Government Accounting Standards Advisory Committee (“GASAC”) and the Accrual Accounting Steering Committee (“ACSC”) to oversee and to manage the development, issuance, and implementation of MPSAS.

Government Accounting Standards Advisory Committee (“GASAC”)

GASAC is the committee responsible for the deliberation of draft MPSAS standards. Various stakeholders of the industry sit in GASAC, being the representatives of the state treasury, ministry of finance, Auditor General’s Office, institutions of higher learning, Malaysian Institute of Accountants (“MIA”), Malaysian Accounting Standards Board (“MASB”), and accounting bodies such as Association of Chartered Certified Accountants (“ACCA”), Malaysian Institute of Certified Public Accountants (“MICPA”), and CPA Australia.

Accrual Accounting Steering Committee (“ACSC”)

ACSC is a one higher-up committee than GASAC. ACSC deliberates, approves and endorses the recommendations made by GASAC on draft MPSAS standards. The Accountant General of Malaysia serves as the Chairman while the members comprises of the senior directors of AGD and Chief Accountants of Federal Ministries.

The development process of MPSAS

MASB issues financial reporting frameworks which are based on the international financial reporting standards issued by the International Accounting Standards Board (“IASB”):

- International Financial Reporting Standards (“IFRS”); and

- IFRS for Small and Medium Enterprises (“IFRS for SMEs”).

Similarly, AGD develops MPSAS financial reporting framework from an international financial reporting framework. MPSAS is drawn primarily from the International Public Sector Accounting Standards (“IPSAS”). The International Public Sector Accounting Standards Board (“IPSASB”), an independent standard-setting body under IFAC, is responsible for the issuance of IPSAS.

GASAC considers IPSAS standards issued by IPSASB for adoption in Malaysia. MPSAS standards are not exactly the same or word-for-word IPSAS. MPSAS amends or change certain requirements in IPSAS for local adoption. Nevertheless, AGD takes the position to maintain, to a large extent, the accounting requirements and original text of IPSAS unless there is a significant public sector issue and local legislation which warrant a departure from IPSAS. Any departure, however, is only upon consultation with various stakeholders.

Normally, the last page of MPSAS standard includes the comparison of MPSAS to its IPSAS equivalent, including an explanation or reason for such departure. So, this is how and where you will be able to understand the differences.

Who are the users of MPSAS

In Accounting 101: Financial Reporting Frameworks in Malaysia, we explain that public sector entities, other than Government Business Enterprises (“GBEs”) use MPSAS. In fact, in that article, we have also explained that GBEs are entities with the following characteristics:

- Firstly, an entity with the power to contract in its own name.

- Secondly, it has been assigned the financial and operational authority to carry on a business.

- Thirdly, it sells goods and services, in the normal course of its business, to other entities at a profit or full cost recovery.

- Fourthly, it is not reliant on continuing government funding to be a going concern (other than purchases of outputs at arm’s length).

- Lastly, it is controlled by a public sector entity.

The above characteristics are based on the old definition of GBE issued. IPSAS, however, replaces GBE term. Instead IPSAS defines and uses the term “public sector entities”.

Under IPSAS, public sector entities are defined as entities that meet all of the following criteria:

- Firstly, public sector entities are responsible for the delivery of services to benefit the public and/or to redistribute income and wealth.

- Secondly, public sector entities finance their activities, directly or indirectly, mainly by means of taxes and/or transfers from other levels of government, social contributions, debt or fees.

- Lastly, public sector entities do not have a primary objective to make profits.

Accordingly, entities which do not meet the above criteria shall not apply IPSAS. This amendment is, however, not yet taken up in MPSAS.

List of MPSAS standards issued to-date

At the time this article is written, there are 35 MPSAS standards issued by the AGD. Out of these 35 standards, 3 standards were superseded by the more recent MPSAS standards. Accordingly, MPSAS standards which are effective, excluding the superseded standards are as follows:

- MPSAS 1 Presentation of Financial Statements

- MPSAS 2 Cash Flow Statements

- MPSAS 3 Accounting Policies, Changes in Accounting Estimates and Errors

- MPSAS 4 The Effect of Changes in Foreign Exchange Rates

- MPSAS 5 Borrowing Costs

- MPSAS 9 Revenue from Exchange Transactions

- MPSAS 11 Construction Contracts

- MPSAS 12 Inventories

- MPSAS 13 Leases

- MPSAS 14 Events After the Reporting Date

- MPSAS 16 Investment Property

- MPSAS 17 Property, Plant and Equipment

- MPSAS 19 Provisions, Contingent Liabilities and Contingent Assets

- MPSAS 20 Related Party Disclosures

- MPSAS 21 Impairment of Non-Cash-Generating Assets

- MPSAS 22 Disclosure of Financial Information

- MPSAS 23 Revenue from Non-Exchange Transactions (Taxes & Transfers)

- MPSAS 24 Presentation of Budget Information in Financial Statements

- MPSAS 25 Employee Benefits

- MPSAS 26 Impairment of Cash-Generating Assets

- MPSAS 27 Agriculture

- MPSAS 28 Financial Instruments: Presentation

- MPSAS 29 Financial Instruments: Recognition and Measurement

- MPSAS 30 Financial Instruments: Disclosure

- MPSAS 31 Intangible Assets

- MPSAS 32 Service Concession Arrangements: Grantor

- MPSAS 33 First-Time Adoption of Accrual Basis MPSASs

- MPSAS 34 Separate Financial Statements

- MPSAS 35 Consolidated Financial Statements

- MPSAS 36 Investments in Associates and Joint Ventures

- MPSAS 37 Joint Arrangements

- MPSAS 38 Disclosure of Interest in Other Entities

MPSAS standards are available on AGD’s website – Malaysian Public Sector Accounting Standards (MPSAS) for reference. You will note that some of the standards above are public sector-specific, namely MPSAS 21, MPSAS 23, and MPSAS 24. This is because the specific nature of the public sector itself requires specific standards to address those areas, which are not applicable or available in the private sector.

List of IPSAS standards yet to be adopted

If you are wondering whether there are any other standards issued by IPSASB but yet to be adopted by AGD, the answer to this is yes. The following list is the IPSAS standards that are yet to be adopted:

- IPSAS 18 Segment Reporting

- IPSAS 39 Employee Benefits

- IPSAS 40 Public Sector Combinations

- IPSAS 41 Financial Instruments

- IPSAS 42 Social Benefits

Conclusion

We hope you now have a quick overview on MPSAS. In our upcoming articles, we will discuss the differences between MPSAS, MPERS, and MFRS on a high-level basis.

In the meantime, please enjoy other articles in the Financial Accounting section.