This article explores the accounting requirements in the preparation of a separate financial statement. IAS 27 Separate Financial Statements provide guidance to the preparers on the accounting and disclosure requirements for an entity that has investments in subsidiaries, joint ventures and associates in their separate financial statements.

The common questions preparers asked are what does it mean by separate financial statements? How does it different from individual financial statements?

So, let’s find out what is separate financial statements and what are the disclosure requirements for separate financial statements.

What are separate financial statements?

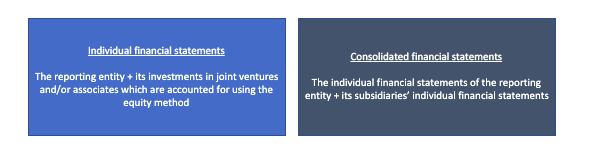

There are three concepts that we need to understand – individual financial statements, consolidated financial statements and separate financial statements.

Individual financial statements

An individual financial statement is not a defined term in IAS 27. Entities generally account for their investments in associates and/or joint ventures using the equity method, unless exempted.

Consolidated financial statements

Consolidated financial statements are the financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and its subsidiaries are presented as those of a single economic entity. IFRS 10 Consolidated Financial Statements provides two consolidation exceptions:

- First exception – Entities do not need to consolidate their subsidiaries. This consolidation exception is applicable to investment entities.

- Second exception – Entities do not need to present consolidated financial statements. This is an exception from preparing consolidated financial statements.

Separate financial statements

So, what is separate financial statements? IAS 27 defines separate financial statements as financial statements presented by an entity in which it could elect (subject to the requirements of IAS 27) to account for its investments in subsidiaries, joint ventures and associates either:

- at cost;

- in accordance with IFRS 9 Financial Instruments; or

- using the equity method as described in IAS 28 Investments in Associates and Joint Ventures.

IAS 27 clearly states that entities prepare separate financial statements as an addition to:

- the consolidated financial statements; or

- the financial statements of investors that do not have investments in subsidiaries but has investments in associates or joint ventures accounted using the equity method.

The financial statements of an entity which does not have a subsidiary, associate or joint venture are not separate financial statements.

The next question is then, when do one prepare the separate financial statements? Separate financial statements may be prepared by entities that are:

- exempted from preparing the consolidated financial statements or

- exempted from applying equity accounting method for their investments in associates and/or joint ventures.

In this case, an entity may present the separate financial statement as its only financial statements.

An investment entity that does not need to consolidate its subsidiaries must prepare separate financial statements. In this case, the separate financial statement is its only financial statements.

How does an entity account for its investments in subsidiaries, joint ventures or associates in the separate financial statements?

When preparing the separate financial statements, entities will account for their investments in subsidiaries, joint ventures and associates either:

- At cost;

- In accordance with IFRS 9 (i.e., at amortised cost or at fair value); or

- Using the equity method as described in IAS 28.

The above choice, however, is not applicable in the following scenario:

- For venture capital organisation or a mutual fund, unit trust and similar entities which held directly or indirectly investments in an associate or a joint venture. If they chose to measure its investments in associates or joint ventures at fair value through profit or loss under IAS 28, the entity should also measure those investments in the same way in the separate financial statements.

- If the parent is required by IFRS 10 Consolidated Financial Statements to measure its investment in a subsidiary at fair value through profit or loss because the parent is an investment entity. The parent should also account for its investment in the subsidiary in the same way in its separate financial statements.

When an entity ceases to be an investment entity, the entity must account for its investment in a subsidiary using any of the methods mentioned above. In another case where a non-investment entity becomes an investment entity, it must account for its investment in a subsidiary at fair value through profit or loss in accordance with IFRS 9.

Disclosure requirements in IAS 27

In addition to the disclosure requirements in this standard, entities should also observe the disclosure requirements in other IFRSs.

Disclosure for a parent that only prepares separate financial statements

IAS 27 requires the following disclosures when a parent, elects not to prepare consolidated financial statements and instead prepares separate financial statements:

- The fact that the financial statements are separate financial statements, that exemption from consolidated has been used, the name and principal place of business of the entity whose consolidated financial statements that comply with IFRS have been produced for public use and the address where those consolidated financial statements are obtainable.

- List of significant investment in subsidiaries, joint ventures and associates, including – (i) name of those investees, (ii) their principal place of business (and country of incorporation if applicable); and (iii) its proportion of the ownership interest (and its proportion of the voting rights) held in those investees.

- A description of the method used to account for the significant investments.

Disclosure for an investment entity parent that prepares separate financial statements

Where an investment entity that is a parent prepares separate financial statements as its only financial statements, IAS 27 requires the parent to disclose this fact in the financial statements. In addition, the investment entity must also observe the disclosures relating to investment entities required by IFRS 12 Disclosure of Interests in Other Entities.

Disclosure for a parent or investor of an associate or joint venture that prepares separate financial statements

Where a parent or an investor with joint control of, or significant influence over an investee prepares separate financial statements, the parent or investor must identify the financial statements prepared in accordance with IFRS 10, IFRS 11 Joint Arrangements and IAS 28 to which they relate. They must also disclose in their separate financial statements, the following information:

- The facts that the statements are separate financial statements and the reasons why they prepare those statements (if not required by law).

- A list of significant investments in subsidiaries joint ventures and associates, including: (i) the name; (ii) the principal place of business (and country of incorporation if applicable) of those investees; and (iii) its proportion of the ownership interest (and its proportion of the voting rights) held in them in those investees.

- A description of the method used to account for those significant investments.

Conclusion

We hope that you have a better understanding of separate financial statements and when entities need to prepare them.

We will bring you more technical discussion in our upcoming articles. Stay tuned for our upcoming articles by following us on social media. Meantime, enjoy other articles in Financial Accounting section or ask your queries by Joining on Community. It is free and open to join for all, now.