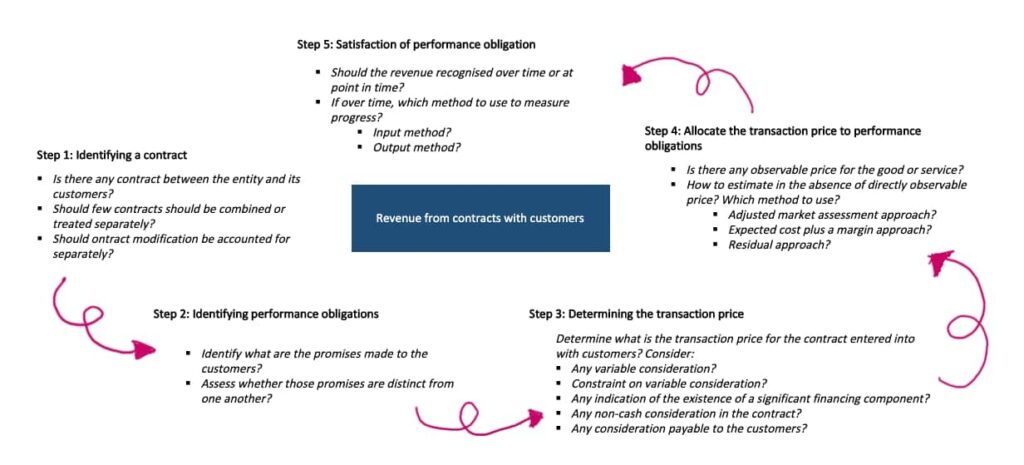

This time, we will continue our previous discussion on the revenue recognition framework in IFRS 15. We have explained in Part 1 that IFRS 15 introduces a single revenue recognition framework for entities across industries. Using this framework, entities follow 5-step process to determine revenue that depict the transfer of promised goods or services to customers.

If you have missed Part 1, or would like to refresh the 5-step, refer to Revenue Recognition in IFRS 15 (Part 1) for explanation on the first two steps of the revenue recognition framework. They are:

- Step 1: Identifying the contracts with a customer

- Step 2: Identifying performance obligations

In this Part 2 of revenue recognition, we continue to discuss the remaining 3 steps of the revenue recognition framework. Let’s now get into the detail.

The Revenue Recognition framework

Remember that entities will first need to consider whether there is a contract going on with its customers. Entities perform this assessment at the contract inception. The conclusion will not change unless there is an indication of a significant change in facts and circumstances. For instance, a significant deterioration in the customer’s ability to pay the consideration when it is due.

If a contract exists, an entity then identify promises to transfer goods or services – i.e., the performance obligations. For this, entities determine whether each promise is distinct from other promises in the contract. If a promised good or service is not distinct, entities combine it with other promised goods or services. Entities combines it until they manage to identify a bundle of goods or services that is distinct.

Step 3: Determine the transaction price

Entities determine transaction price based on the terms of the contract and entities’ customary business practices. Transaction price reflects the amount of consideration to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer. As such, entities do not include amount collected on behalf of third parties as a transaction price.

The transaction price may be variable amounts, fixed amounts or a combination of both. One of the presumptions when determining the transaction price is that entities will transfer the goods or services to the customers as promised in the contract and that the contract will not be cancelled, renewed or modified.

In determining the transaction price, an entity considers the effects of the following:

- Variable consideration

- Constraining estimates of variable consideration

- The existence of a significant financing component in the contract

- Non-cash consideration

- The consideration payable to a customer.

A) Variable consideration

IFRS 15 requires an entity to estimate the amount of consideration if the consideration includes a variable consideration. The amount of consideration to be received by an entity may be affected by discounts, rebates, refunds, credits and others. The amount of consideration may also be contingent on the occurrence or non-occurrence of a future event. For example, a right for return or performance bonus on achievement of a certain target.

In estimating the variable consideration, IFRS 15 explains entities use either the following methods:

- The expected value – is the sum of probability-weighted amounts in a range of possible consideration amounts. This method may be appropriate if an entity has a large number of contracts with similar characteristics.

- The most likely amount – represents the single most likely amount in a range of possible consideration amounts. This method may be appropriate if the contract has only two possible outcomes.

Entities apply the method chosen consistently throughout the contract. An entity is however, required to reassess or update the estimated transaction price at the end of each reporting period. Entities need to allocate any changes to the transaction price. Entities allocate the changes to the performance obligations in the contract the same way as at the contract inception.

B) Constraining estimates of variable consideration

IFRS 15 requires an entity to include in the transaction price some or all of the variable consideration. The inclusion is only to the extent that it is highly probable that a significant reversal in the amount of cumulative revenue recognised will not occur when the uncertainty associated with the variable consideration is resolved.

For this, an entity considers both the likelihood and the magnitude of the revenue reversal. IFRS 15 also requires an entity to update its assessment of whether an estimate of variable consideration is constrained at the end of each reporting period.

C) The existence of a significant financing component in the contract

IFRS 15 requires an entity to adjust the transaction price for the effects of the time value of money. This adjustment is when the timing of payments provides the customer or the entity with a significant benefit of financing the transfer of goods or services to the customer. The promise to finance may explicitly be stated in the contract or implied by the payment terms agreed by the parties to the contract.

Assessment of a significant financing component

In assessing whether there is a significant financing component, an entity considers:

- The difference between the amount of promised consideration and the cash selling price of the promised goods or services; and

- The combined effect of (a) the expected length of time between the transfers of promised goods or services and when the customer pays for it; and (b) the prevailing interest rates in the relevant market.

Factors where a significant financing component does not exist

A significant financing component, however, does not exist in any of the following factors:

- The customer paid in advance and the timing of the transfer of goods or services is at the discretion of the customer.

- A substantial amount of consideration and the amount or timing of that consideration varies based on the occurrence or non-occurrence of a future event that is not substantially within the control of the customer or the entity.

- The difference between the promised consideration and the cash selling price arises for reasons other than the provision of finance to either the customer or the entity and the difference between those amounts is proportional to the reason for the difference.

An entity should not adjust the promised amount of consideration for the effects of a significant financing component if the period between transfers of goods or services and its payment is 12 months or less. The discount rate used must also reflect the credit characteristics of the party receiving financing in the contract as well as the collateral or security provided, including assets transferred in the contract. Such a rate should not be updated or adjusted after the contract inception.

D) Non-cash consideration

IFRS 15 requires an entity to measure the non-cash consideration (or promise of non-cash consideration) at fair value. However, if entities cannot estimate the fair value reasonably, an entity should measure the consideration indirectly by reference to the stand-alone selling price of the goods or services promised to the customer.

E) The consideration payable to a customer

This amount includes the cash amount that an entity pays or expects to pay to the customer. It also includes credit or other items that customers can apply against the amount owed to the entity. Entities should treat the consideration payable to a customer as a reduction of the transaction price or revenue, unless the payment is in exchange for a distinct good or service that the customer transfers to the entity.

Step 4: Allocating the transaction price to performance obligations

Once the transaction price of the contract with customers has been determined, the next step is to allocate them to each performance obligation or distinct good or service. Entities allocate the transaction price in an amount that reflects the amount of consideration to which the entity expects to receive in exchange for transferring the promised goods or services to the customer. Entities allocate the transaction price on a relative stand-alone selling price basis.

What is a stand-alone selling price and what does it mean by allocation based on stand-alone selling prices? The stand-alone selling price represents the price at which an entity would sell a promised good or service separately to a customer. After determining the stand-alone selling price of goods or services underlying each performance obligation in the contract, the entity will then allocate the transaction price to each performance obligation in proportion to their stand-alone selling price.

Determining stand-alone selling price

The stand-alone selling price is generally the observable price of a good or service when it is sold separately in similar circumstances to similar customers. Take note that a contractually stated price or a price list may be the stand-alone selling price but this may not necessarily be the case.

When the stand-alone selling price is not directly observable, IFRS 15 requires an entity to estimate it by maximising the use of observable inputs and apply estimation methods consistently.

IFRS 15 also states that the suitable methods for estimating the stand-alone selling price include:

- Adjusted market assessment approach – evaluating the market in which it sells goods or services and estimates the price that a customer in that market would be willing to pay.

- Expected cost plus a margin approach – forecast its expected costs and then add an appropriate margin for that good or service.

- Residual approach – estimate the stand-alone selling price by reference to the total transaction price less the sum of the observable stand-alone prices of other goods or services. However, entities must meet certain conditions if they want to use this approach.

Can we combine the methods above to estimate the stand-alone selling price? The answer is a yes. Entities may use a combination of methods to estimate the stand-alone selling price.

Step 5: Satisfaction of performance obligations

Once entities has allocated the transaction price to the performance obligations, the next step is to recognise revenue. An entity will only recognise revenue when or as an entity satisfies a performance obligation. A performance obligation is satisfied when or as an entity transferring a promised good or service to a customer and the customer obtains control of the asset.

Control of an asset refers to the ability to direct the use of and obtain substantially all of the remaining benefits from the asset. It also includes the ability to prevent other entities from directing the use of and obtaining the benefits from an asset.

Over time or at a point in time satisfaction

Each performance obligation can either be satisfied over time or at a point in time. An entity transfers control over time (and recognise revenue over time) only if one of the following criteria is met:

- The customer simultaneously receives and consumes the benefits provided by the entity’s performance as the entity performs.

- The entity’s performance creates or enhances an asset that the customer controls as the asset is created it enhanced.

- The entity’s performance does not create an asset with an alternative use to the entity and the entity has an enforceable right to payment for performance completed to date.

Otherwise, entities satisfy the performance obligation at a point in time. But how do we know at which point in time entities transfer the control? In determining this, an entity considers the following indicators:

- First indicator is whether the entity has a present right to payment for the asset.

- Second indicator is whether the entity has transferred physical possession of the asset.

- Thirdly, whether the customer has legal title to the asset.

- Next indicator is whether the customer has the significant risks and rewards of ownership of the asset.

- Lastly, whether the customer has accepted the asset.

Measuring the progress – input or output method

The next question is if a performance obligation is satisfied over time, how do we measure an entity’s progress towards complete satisfaction of the performance obligation? IFRS 15 requires an entity to measure the progress using either the input method or the output method for each performance obligation satisfied over time.

| Input method | Output method |

|---|---|

| Recognise revenue based on the entity’s efforts or inputs to the satisfaction of a performance obligation | Revenue is recognised based on the direct measurement of the value to the customer of the goods or services transferred to date relating to the remaining goods or services promised in the contract |

| Examples: – Resources consumed – Labour hours expended – Cost incurred – Time elapsed – Machine hours used | Examples: – Survey of performance completed to date – Milestones reached – Time elapsed – Units produced or delivered – Appraisals of results achieved |

Entities must apply the method chosen consistently to similar performance obligation in similar circumstances. At the end of each reporting period, an entity re-measures its progress again.

Conclusion

With this, we have now concluded the key principles in the revenue recognition principles in IFRS 15. More detailed guidance on revenue recognition is available in IFRS 15 for further guidance on the 5-step above. In addition to revenue recognition principles, IFRS 15 also provides guidance on the accounting for contract costs and presentation of revenue and its related items in the financial statements.

We will continue our discussion on other financial reporting requirements in our future articles. Meantime, enjoy other articles in the Financial Accounting Section.