The topic of impairment of asset continues to be a topic of discussion, especially because of the COVID-19 pandemic. In fact, impairment of assets is one of the main focuses, as explained in Top 5 accounting considerations for FY 2020 financial reporting. There are more reasons for under-utilisation of assets due to the economy slowing down. As a result, it leads to impairment issues. For this, IAS 36 Impairment of Assets stipulates the requirements and procedures in relation to impairment of assets.

The focus of this article is on explaining impairment loss and how to know if assets need an impairment. IAS 36 applies for the impairment of all assets except:

- Inventories.

- Contract assets and assets arising from costs to obtain or fulfil a contract.

- Deferred tax assets.

- Assets arising from employee benefits.

- Financial assets within IFRS 9 Financial Instruments.

- Investment property measured at fair value.

- Biological assets related to agricultural activity.

- Deferred acquisition costs and intangible assets arising from an insurer’s contractual rights under insurance contracts.

- Non-current assets (or disposal groups) classified as held for sale.

Let us now dive into the details.

What is an impairment loss of asset?

For this, IAS 36 defines an impairment loss as the amount by which the carrying amount of an asset or a cash-generating unit (“CGU”) exceeds its recoverable amount.

Carrying amount of assets or CGU > Recoverable amount = Impairment loss

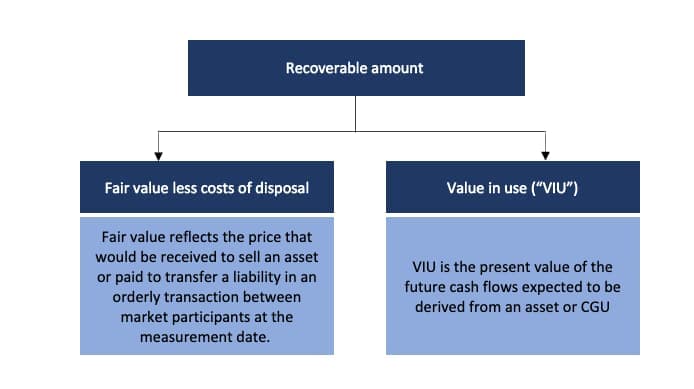

The recoverable amount reflects the economic benefits that an entity expects to utilise from the asset. A recoverable amount is the higher of fair value less costs to disposal and its value in use.

When do we know we need to impair an asset or a CGU?

Entities must first identify assets that require impairment. This is when the asset’s carrying amount exceeds its recoverable amount. Still, this does not mean entities always need to perform impairment assessment. Above all, entities only assess the recoverable amount when the asset’s or a CGU’s impairment indicator(s) exist. In the absence of such an indicator, entities do not need to perform assessment of the recoverable amount.

Indicators of impairment of asset

IAS 36 outlines minimum indicators using both external and internal sources of information. However, they are not exhaustive.

Internal sources of information

Below is the list of internal sources of information in IAS 36:

- Observable indications on the decline in the asset’s value during the period significantly more than as a result of the passage of time or normal use.

- Significant changes with an adverse effect have taken place or will take place in the near future on the entity, in the technological, market, economic or legal environment in which the entity operates or in the market an asset is dedicated.

- Market interest rates or other market rates of return on investment have increased and those increases are likely to affect the discount rate used in calculating an asset’s VIU and decrease the asset’s recoverable amount materially.

- The carrying amount of the net assets of the entity is more than its market capitalisation.

External sources of information

Below is the list of external sources of information in IAS 36:

- Evidence is available of obsolescence or physical damage of an asset.

- Significant changes with an adverse effect on the entity have taken place or are expected to take place in the near future, in the extent to which, or manner in which, an asset is used or expected to be used.

- The evidence available from internal reporting that indicates the economic performance of an asset is, or will be, worse than expected.

- Evidence from dividend from a subsidiary, joint venture or associate that:

- The carrying amount of the investment in the separate financial statements exceeds the carrying amounts in the consolidated financial statements of the investee’s net assets, including associated goodwill.

- The dividend exceeds the total comprehensive income of the subsidiary, joint venture or associate in the period the dividend is declared.

However, there is an exception but it applies only for the following assets:

- First, an intangible asset with an indefinite useful life or an intangible asset not yet available for use.

- And second, goodwill acquired in a business combination.

For the assets above, annual impairment assessment is mandatory, irrespective of whether an indication exist.

When there is an indication for an impairment of asset, entities must revisit: (i) the asset’s remaining useful life, (ii) the depreciation (or amortisation) method or (iii) the residual value, even if no recognition of impairment loss.

How do we calculate the recoverable amount?

The recoverable amount is the higher of an asset’s or CGU’s fair value less costs of disposal and its VIU. The determination of recoverable amount is for an individual asset. Except, if the asset does not generate cash inflows that are largely independent from other assets or groups of assets.

Let’s us see how we determine them.

Fair value less costs of disposal

Entities follow the guidance in IFRS 13 Fair Value Measurement to determine the asset’s fair value. After determining the fair value, entities subsequently deduct costs of disposal from the fair value. Examples are legal costs, stamp duty, costs of removing the asset and other appropriate costs.

Value in use

The calculation of an asset’s value in use must reflect:

- An estimate of the future cash flows expected derive from the asset;

- Expectation about possible variations in the amount or timing of those future cash flows;

- The time value of money, represented by the current market risk-free rate of interest;

- The price for bearing the uncertainty inherent in the asset; and

- Also, other factors such as illiquidity.

Entities must (1) estimate the future cash inflows and outflows expected from continuing use of the asset and its ultimate disposal; and (2) apply the appropriate discount rate to those future cash flows, in the VIU calculation. Because VIU is the present value of the expected future cash flows, entities have to use an appropriate discount rate. For this, an entity uses a pre-tax rate that reflects the current market assessment of the time value of money and the risk specific to the asset.

Entities do not need to figure out both fair value less costs of disposal and VIU. For example, if either one of these amounts exceeds the asset’s carrying amount.

How do we estimate future cash flows for VIU?

Next is how to estimate future cash flows? In estimating future cash flows, entities use:

- Management’s best estimate – Base the cash flow projections on reasonable and supportable assumptions that reflect management’s best estimate of the range of economic conditions that will exist over the remaining useful life of the asset.

- Recent financial forecasts/budgets – Base the cash flow projections on the most recent financial budgets/forecasts approved by management, excluding those related to future restructurings or from enhancing the asset’s performance.

- Extrapolation – Estimate cash flow projections beyond the period covered by the most recent budgets/forecasts by extrapolating the projections based on the budgets/forecasts using a steady or declining growth rate for later years unless an increasing rate can be justified.

The future cash flows include (i) projections of cash inflows from continuing use of the asset, (ii) expected cash outflows that are necessary to generate the cash inflows, and (iii) net cash flows for the disposal of the asset at the end of its useful life. It does not include cash inflows or outflows from financing activities or income tax receipts or payments.

How do we recognise an impairment loss?

Entities recognise immediately an impairment loss in profit or loss, except for assets carried at revalued amount. To clarify, an impairment loss reduces the asset’s carrying amount. In contrast, what if it is a CGU rather than an individual asset? CGU is the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets.

How do we then allocate the impairment loss to the assets in the CGU? Entities allocate the impairment loss by reducing the individual asset’s carrying amount in the following order:

- Firstly, the impairment loss reduces the carrying amount of any goodwill allocated to the CGU;

- Then, allocates the excess of the impairment loss to other assets of the unit on a pro-rata basis based on the carrying amount of each asset in the unit.

The reduction of the carrying amount of an asset, however, should not be below the highest of (i) its fair value less costs of disposal; (ii) its VIU; and (iii) zero. In such a situation, the amount of the impairment loss is allocated on pro-rata to the other assets of the unit.

Can we reverse impairment loss previously recognised?

The answer is yes. We reverse impairment loss when the indication is no longer exist or when the impairment loss has decreased. When this happened, the reversal is recognised immediately in profit or loss, except for the assets carried at revalued amount. Nevertheless, the impairment loss recognised for goodwill should never be reversed.

The reversal of an impairment loss for a CGU is allocated to the individual asset on a pro-rata basis based on the assets’ carrying amount. The reversal of impairment loss increases the asset’s carrying amount. Nevertheless, the carrying amount should not be increased above the lower of:

- Its recoverable amount; and

- The carrying amount had no impairment loss been recognised for the asset in the prior period.

The amount of the reversal of the impairment loss is then allocated on pro-rata to the other assets of the unit.

Goodwill and corporate assets

Goodwill acquired in a business combination does not generate cash flows independently of other assets or groups of assets. It often contributes to the cash flows of multiple CGUs. As such, goodwill acquired in a business combination is allocated to each of the acquirer’s CGU that is expected to benefit from the synergies of the combination.

Corporate assets are assets other than goodwill that contribute to the future cash flows of both the CGU under review and other CGUs. Entities must identify all corporate assets that relate to the CGU under review before assessing and recognising the impairment loss.

The above now summarises the key principles for impairment of assets. The standard provides more detailed guidance and explanation on the key principles. In practice, there are lots of significant judgments and estimates involved in this area.

We will continue our discussion on other financial reporting requirements in our future articles. Meantime, enjoy other articles in the Financial Accounting Section.