The financial reporting framework is the framework that an entity uses to prepare its financial statements. In this article, we discuss the financial reporting frameworks commonly used by entities in Malaysia.

Reporting entities are generally divided into two sectors – public sector and private sector. In Malaysia, public sector entities generally prepare their financial statements based on the Malaysian Public Sector Accounting Standards (“MPSAS”). Private sector entities on the other hand, prepare their financial statements based on either the Malaysian Private Entities Reporting Standard (“MPERS”) or the Malaysian Financial Reporting Standards (“MFRS”).

About the financial reporting frameworks

In this section, we further discuss the three financial reporting frameworks above – MFRS, MPERS and MPSAS.

Financial reporting frameworks for private sector

Certain private sector entities in Malaysia are using MPERS while some are using MFRS. The following section discusses how an entity determines whether it should be using MPERS or MFRS.

The Malaysian Accounting Standards Board (“MASB”) issues both MPERS and MFRS. MASB is the standard-setting body responsibles to issue approved accounting standards for the preparation of financial statements in Malaysia. Entities that are required to prepare and lodge their financial statements under the law administered by the Securities Commission of Malaysia (“SC”), the Central Bank of Malaysia, and/or the Companies Commission of Malaysia (“CCM”) must use the accounting standards issued by MASB. MASB is governed or administered by the Financial Reporting Foundation (“FRF”), established under the Financial Reporting Act 1997.

The Malaysian Financial Reporting Standards Framework

MFRS framework is in full compliance with the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”), following the convergence exercise undertaken by Malaysia. This means MFRS standards, including its amendments and interpretations, are word-for-word with IFRS.

The Malaysian Private Entities Standard Framework

MPERS is closely aligned with the International Financial Reporting Standards for Small and Medium-sized Entities (“IFRS for SMEs”). IFRS for SMEs is similarly issued by the IASB. As MPERS is closely aligned with the IFRS for SMEs, the application of MPERS is generally consistent with international practice. The differences between MPERS and IFRS for SMEs are only in the following areas:

- Firstly, Section 1 Private Entities of MPERS with regard to the applicability of MPERS in the Malaysian context.

- Secondly, Section 9 Consolidated and Separate Financial Statements of MPERS. The section requires the ultimate Malaysian parent to prepare consolidated financial statements regardless of whether its ultimate parent (foreign parent) prepares consolidated financial statements.

- Lastly, Section 34 Specialised Activities of MPERS. The section includes additional guidance on the accounting for property development activities based on FRS 201 Property Development Activities. It also deletes Example 12 contained in the Appendix to Section 23 of MPERS.

Why private sector entities need two different frameworks? MFRS and MPERS cater to different sets or scales of entities. The aim of each framework is as follows:

| MFRS | MPERS |

|---|---|

| MFRS is a full suite standard aimed for non-private entities that are required to prepare and lodge their financial statements with the SC, Central Bank of Malaysia, and/or CCM. | MPERS is a simplified financial reporting framework to be used by private entities. A private entity is further defined and explained below. MPERS provides simplification to certain accounting requirements to account for transactions or events on the basis of cost-benefit, taking into consideration the reporting responsibility of private entities. |

Having said this, an entity that meets the definition of a private entity may still elect to use MFRS framework if they chose to do so. The full set of MPERS and MFRS are available on the MASB’s website.

The Malaysian Public Sector Accounting Standards Framework

Public sector entities such as federal, state, and local governments in Malaysia apply MPSAS. MPSAS is a different set of financial reporting framework, specific for public sector entities other than Government Business Enterprises (“GBEs”).

Government Business Enterprises

GBEs apply financial reporting standards issued by the MASB – either MFRS or MPERS. MPSAS 1 Presentation of Financial Statements defines GBEs as an entity that has all the following five (5) characteristics:

- Is an entity with the power to contract in its own name;

- Has been assigned the financial and operational authority to carry on a business;

- Sells goods and services, in the normal course of its business, to other entities at a profit or full cost recovery;

- Is not reliant on continuing government funding to be a going concern (other than purchases of outputs at arm’s length);

- And is controlled by a public sector entity.

MPSAS framework falls under the purview of the Accountant General’s Department of Malaysia (“AGD”). It is based on the International Public Sector Accounting Standards (“IPSASs”) issued by the International Federation of Accountants (“IFAC”). MPSAS has to a very large extent, maintained the accounting requirements and original text of IPSASs unless there are any specific public sector issues and local laws and legislations that warrant a departure.

Because MPSAS is specific for public sector entities, certain standards are only available in MPSAS, not MPERS and MFRS. They are:

- MPSAS 21 Impairment of Non-Cash Generating Assets

- MPSAS 23 Revenue from Non-Exchange Transactions (Taxes & Transfers)

- MPSAS 24 Presentation of Budget Information in Financial Statements

- MPSAS 32 Service Concession Arrangements: Grantor

- MPSAS 33 First Time Adoption of Accrual Basis MPSASs.

The complete set of issued MPSAS is available on AGD’s website – Malaysian Public Sector Accounting Standards (MPSAS).

Determining the financial reporting framework to use

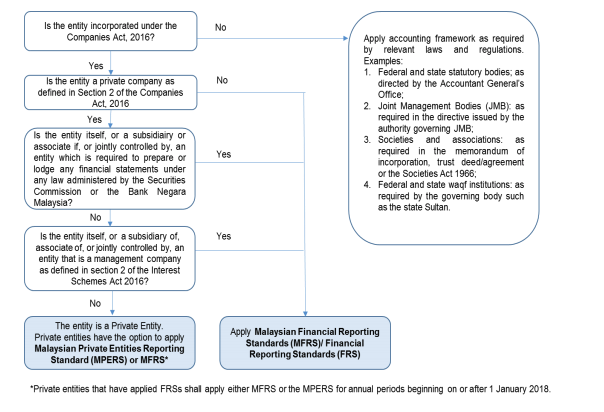

So, how do we know which financial reporting framework an entity should be using? The Malaysian Institute of Accountants (“MIA”) had issued a decision tree through its Frequently-Asked Questions (FAQs) on Malaysian Private Entities Reporting Standard to help an entity to determine which financial reporting framework should they use.

The decision tree is as follows:

The first question in the decision tree is whether the entity incorporated under the Companies Act 2016. This aims to address the question of whether an entity is a private sector, public sector or some other entities such as societies, joint-management body and association. It helps to establish the appropriate approving authority with regard to the financial reporting responsibility of the entity.

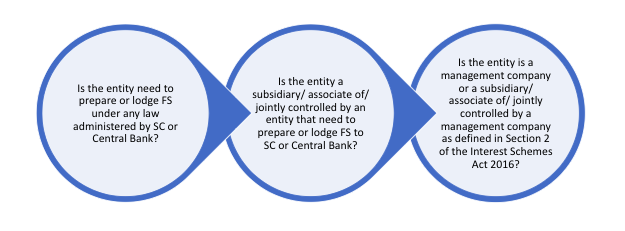

The subsequent questions in the decision tree help an entity to assess and determine whether it can use MPERS. As explained earlier, MPERS is only applicable to private entities. The Companies Act 2016 does not define private entity. However, paragraph 1.2 of MPERS explains what is private entity.

Paragraph 1.2 of MPERS defines private entity as a private company with 2 criteria:

- is not itself required to prepare or lodge any financial statements under any law administered by the Securities Commission or Bank Negara Malaysia; and

- is not a subsidiary or associate of, or jointly controlled by, an entity which is required to prepare or lodge any financial statements under any law administered by the Securities Commission or Bank Negara Malaysia.

Section 1.2 of MPERS further added that a private company that is itself, or is a subsidiary or associate of, or jointly controlled by, an entity that is a management company as defined in Section 2 of the Interest Schemes Act 2016 is not a private entity.

To know whether the company is a private company, an entity will need to refer to the Companies Act 2016 for the definition.

What if an entity is not listed in the examples in the decision tree above? In such a situation, it is important for the entity to assess and determine the reporting body or authority that the entity needs to report and the act which governs its financial reporting obligation.