On 12 February 2021, the IFRS Interpretation Committee (“IFRIC”) issued a tentative agenda decision on the issue relating to the preparation of financial statements when an entity is no longer a going concern. The tentative agenda decision is open for public comments until 14 April 2021. This issue submitted to IFRIC is quite an interesting issue and is commonly asked by preparers.

In our previous article on agenda decision – IFRIC Agenda Decision: How does it affect you?, we have explained the role of the IFRIC Agenda Decision to an entity. So, if this IFRIC Tentative Agenda Decision gets approved without changes to the direction and decision, the guidance in this tentative agenda decision will also guide an entity facing with similar issue. Let’s now get into the details of the issue.

What is issue submitted to IFRIC

On this topic relating to the preparation of financial statements when an entity is no longer a going concern, there were two fact patterns or questions specifically asked to IFRIC as follows:

- Can an entity prepare financial statements for prior periods on a going concern basis if it was a going concern in those periods and has not previously prepared financial statements for those periods?

- Does an entity need to restate the comparative information to reflect the basis of accounting used in the current period’s financial statements if it had previously issued financial statements for the comparative period on a going concern basis?

Let’s now see the illustration of the fact patterns above as extracted from the staff paper for IFRIC February 2021 meeting.

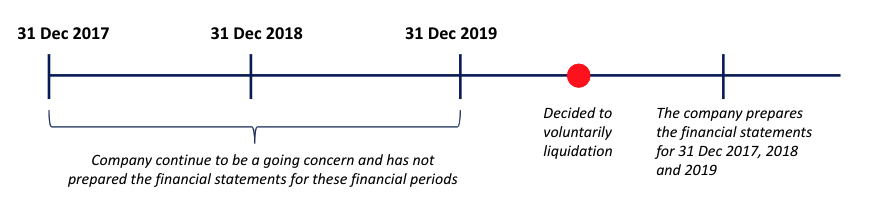

Fact pattern 1

An entity has not prepared financial statements for annual reporting periods ended 31 December 2017, 31 December 2018 and 31 December 2019. Management concluded that the entity was able to continue as a going concern during 2017, 2018 and 2019. However, in 2020, the entity’s management decided to voluntarily liquidate the entity. After this decision was made, the entity prepares financial statements for each of the annual reporting periods ended 31 December 2017 (2017 financial statements), 31 December 2018 (2018 financial statements) and 31 December 2019 (2019 financial statements).

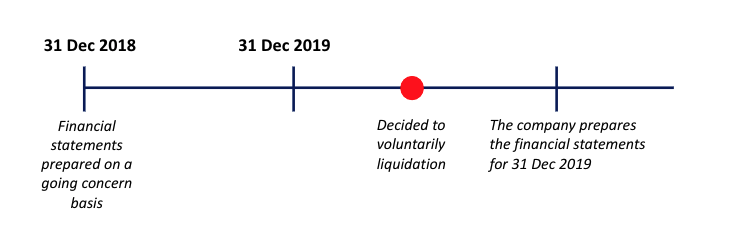

Fact pattern 2

Assume the entity in fact pattern 1 had previously prepared its 2018 financial statements on a going concern basis. Applying paragraph 14 of IAS 10, the entity can no longer prepare its financial statements on a going concern basis and, accordingly, prepares its 2019 financial statements on an alternate basis (non-going concern basis). The question raised is whether in preparing its 2019 financial statements, the entity is required to restate the comparative information in respect of the preceding period to reflect the non-going concern basis.

The requirements of the IFRS on going concern and subsequent events

Paragraph 25 of IAS 1 Presentation of Financial Statements states that one of the principles in the preparation of the financial statements is the ability of the entity to continue as a going concern. This is because the financial statement is prepared based on a going concern basis. Should the entity do not have the ability to continue as a going concern, the financial statements will be prepared on another basis. We have covered this principle in our Accounting 101 series – Consideration for the presentation of financial statements.

IAS 10 Events after the Reporting Period addresses the issue of whether an entity needs to adjust its financial statement numbers to reflect event(s) that took place after the reporting period. In the issues submitted to IFRIC, the event that took place after the reporting period is the management decision to voluntarily liquidate the company. Paragraph 14 of IAS 10 states that “an entity shall not prepare its financial statements on a going concern basis if management determines after the reporting period either it intends to liquidate the entity or to cease trading, or that it has no realistic alternative but to do so.”

The scenario submitted will likely to happen especially for fact pattern 2 due to tough economic conditions from the COVID-19 pandemic. It is quite common we see more and more businesses closing down as they are no longer able to sustain or take the hit from the economic slowdown.

IFRIC tentative agenda decisions

When IFRIC discussed the issues above in its February 2021 meeting, IFRIC has tentatively decided on the following:

- Fact pattern 1 – Paragraph 25 of IAS 1 and paragraph 14 of IAS 10 are clear that an entity that is no longer a going concern cannot prepare the financial statements (including those for prior periods that have not yet been authorised for issue) on a going concern basis. Taking into the fact that the financial statements of those prior periods will be dated current, financial statements for 31 December 2017, 31 December 2018 and 31 December 2019 will be prepared on a non-going concern basis.

- Fact pattern 2 – IFRIC noted that with regard to fact pattern 2, there is no diversity in practice where entities normally do not restate the comparative information (31 December 2018) to reflect the basis used for the preparation of financial statements for the current period (31 December 2019). As such, IFRIC decided not to proceed with the issue.

The above decisions, if finalised without any changes, are expected to help to provide guidance to the preparers in their preparation of financial statements. You can refer to the IFRIC Update February 2021 for this tentative agenda decision. We will update you by updating this article once the decisions have been finalised or should there be any changes to the tentative decisions. Till then. Stay tuned!