As many Malaysian are in the budget spirit following the Malaysia 2021 Budget announcement made by the Finance Minister on Friday, 6th November 2020, this article discusses MPSAS 24 Presentation of Budget Information in Financial Statements.

MPSAS 24 is an interesting standard because it helps users to understand how public sector entities utilised the allocated budget. The standard, however, is applicable only for entities that are either:

- required to make publicly available their approved budgets that they are publicly accountable; or

- elect to make publicly available their approved budget.

So, you may not be able to see this information in all public sector entities’ financial statements.

In Malaysia, the Accountant General’s Department of Malaysia issued MPSAS 24 in June 2013. The standard adopts the financial reporting requirements in IPSAS 24 issued by the International Public Sector Accounting Standards Board (“IPSASB”).

The objective of the standard is to inform the users on how entities discharge their accountability on the allocated budget. Additionally, the standard also allows entities to being transparent in demonstrating compliance with the approved budgets. Take note that there is no MPSAS 24 equivalent for the private sector applying the Malaysian Financial Reporting Standards (“MFRS”) or Malaysian Private Entities Reporting Standard (“MPERS”).

Presentation of Budget Information in Financial Statements – the requirements of MPSAS 24

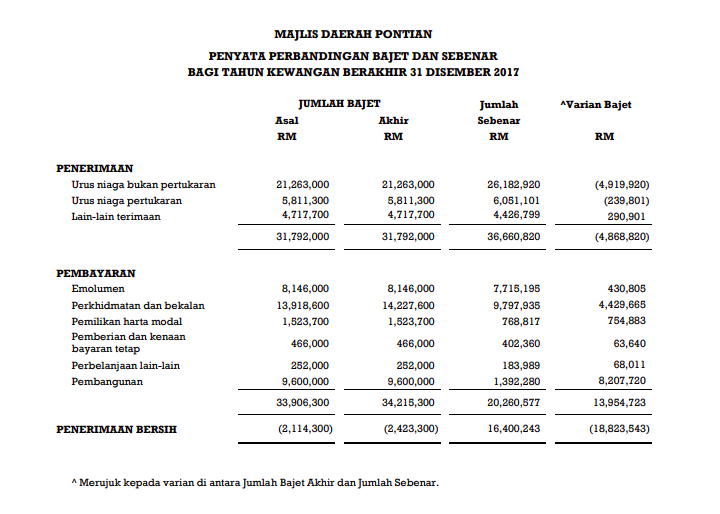

MPSAS 24 requires public sector entities to present a comparison of budget amount and the actual amount spent. This comparison comes together with an explanation of the reasons for material differences between the two.

Entities determine material differences either by focusing on performance against the original budget or on compliance with the final budget. Entities present the comparison either as:

- a separate additional financial statement; or

- an additional budget column in the MPSAS financial statements.

In addition, where the approved budgets are publicly available for some activities, public sector entities present the budget information only for those activities.

Changes to the original budget

It is common in public sector to have changes to the original budget allocated. How should entities report this in their financial statements?

The nature of the changes

MPSAS 24 requires entities to explain any changes from the original budget to the final budget. The final budget includes supplemental appropriations where the original budget did not envisage certain expenditure requirements. For example additional or supplemental budget following natural disasters. The final budget may also include budget cuts from the original amount appropriated. For instance, significant shortfall from budgeted revenues or reallocation of budget arising from the re-prioritisation of funding.

Entities may present an explanation of the changes in the notes to the financial statements or in a report issued before, at the same time, or in conjunction with the financial statements. Entities need to make an appropriate cross-reference in the financial statements.

Budget information versus financial statements

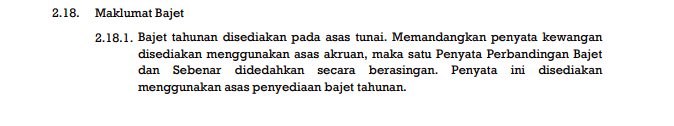

MPSAS 24 requires public sector entities to present a comparison of budget and actual amounts on the same comparable basis – i.e. accounting, classification, entities, and period – as the approved budget.

The challenge is when entities prepare the budgets on a different basis from the actual amounts presented in the financial statements. For instance, entities may prepare budgets based on cash basis while present the actual amounts in the financial statements on an accrual basis.

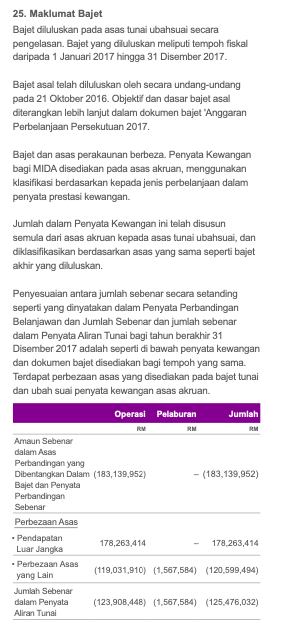

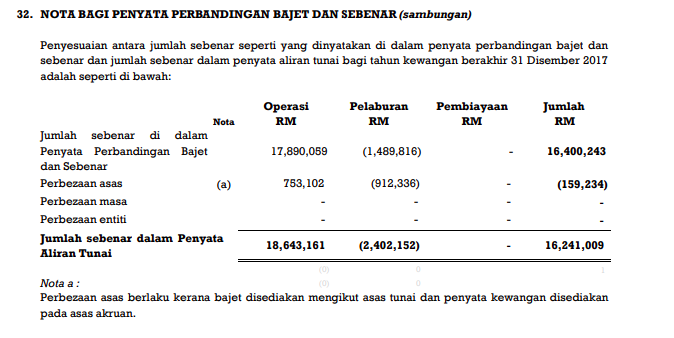

Where entities did not prepare the budget on a comparable basis as to the financial statements, MPSAS 24 further requires entities to prepare a reconciliation to the actual amount. The reconciliation must identifying the basis, timing, and entity differences in either the face of the statement of comparison or in the notes to the financial statements.

Other presentation and disclosure requirements

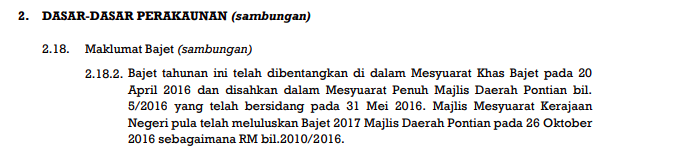

In addition to the above, MPSAS 24 requires public sector entities to disclose, in the notes to the financial statements:

- the period of the approved budget;

- the entities included in the approved budget which may not be the same as entities included in the preparation of financial statements;

- budgetary basis and classification basis adopted in the approved budget.

MPSAS 24 however, does not require public sector entities to present comparative information for the previous period in accordance with the requirements of the standard.

Essentially, the comparison between budget and actual amount in the prior period together with the related explanations of differences between the actuals and budget of the previous period are not required to be presented or disclosed in the financial statements of the current period.

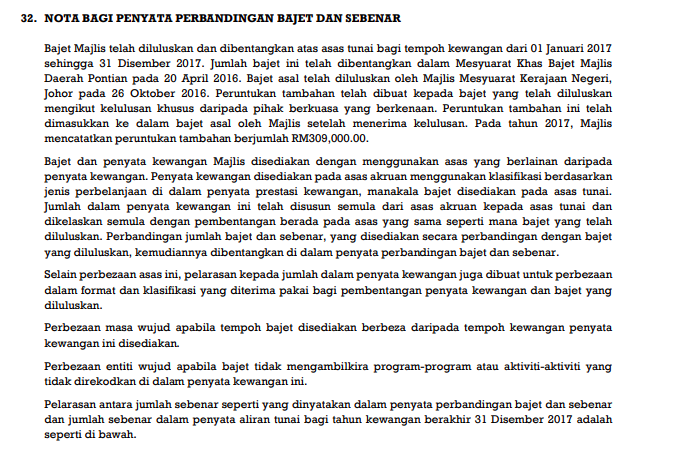

Examples of disclosure of budget in the financial statements are as follows:

- 2017 financial statements of the Malaysian Investment Development Authority (“MIDA”)

- 2017 financial statements for Majlis Daerah Pontian

Illustrative examples of how the comparison of budget and actual amounts are also included in the full version of the standard. The full version of MPSAS 24 Presentation of Budget Information in Financial Statements is available on the website of Jabatan Akauntan Negara.