This is our very first article for Islamic Finance and for this, we first provide you an introduction to Islamic Finance. It is our hope that the Islamic Finance series will help you to understand or at least to have some answers to the questions like:

- What is Islamic Finance?

- Why is there even a need for religion-based finance?

- What is the difference between Islamic Finance and conventional finance?

In the later part of this article, we also explain to you what are the prohibited elements in Islamic Finance. Let us now go into the details.

What is Islamic Finance?

The concept of Islamic Finance consists of two elements as its name – Islam and Finance. Finance is an area where it focuses on the management, creation and study of money and investments. While Islam on the other hand is the religion for Muslims.

For Muslims, Islam goes beyond just a religion. In fact, Islam is the way of living. It covers and governs various aspects of living – from the Aqidah, Akhlaq and Fiqh of the Muslims.

- Aqidah – This is the starting point or foundation of being a Muslim. The foundation of aqidah lies in the six pillars of faith (iman), represents Muslim’s belief in:

- Allah

- The Angels

- Divine revelations

- The Messengers

- Hereafter

- The Divine Will.

- Akhlaq – It represents the virtue, morality and manners of the Muslims. Akhlaq covers various aspects such as the way Muslims behave, their attitude, and work ethics.

- Fiqh – This represents the Islamic laws, specifically the Shariah rulings relating to Muslim conducts in various aspects such as rules relating to:

- ibadat (e.g., prayer, fasting, pilgrimage, zakat and others)

- muamalat (commercial transactions such as buying and selling, debts, contracts and others)

- munakahat (family affairs such as marriage, guardianship and others); and

- jinayat (criminal offences like theft, robbery and others).

Islamic Finance is essentially financial activities. However, the conduct of activities is based on Shariah as per the Islamic teaching. Because of this, Islamic Finance is different from conventional finance. This is mainly because in Islamic Finance, meeting the Shariah requirements is the main objective or overarching mission.

The importance of meeting the Shariah requirements

Why is meeting the Shariah requirements or Islamic law important for Muslims? For this, note that Muslims believe that the world is only a temporary destination. Every Muslim will be held accountable for his or her actions during the lifetime. Allah will judge the actions to determine their final place in Hereafter. Accordingly, Muslims need to also ensure their business and commercial dealings are consistent or in line with Islamic teaching. This includes for Muslims to avoid prohibited elements in any business transactions or dealings.

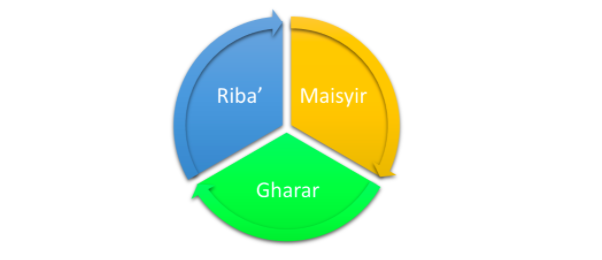

The prohibited elements in Islamic Finance

Prohibited elements differentiate Islamic Finance from the conventional. None of the prohibited elements should exist in Islamic Finance dealings. Otherwise, such transactions are not Shariah compliance.

What are these prohibited elements? They are:

1. Riba’

Riba’ or also referred to as usury is an excessive, unjust and exploitative profit. It is clearly prohibited and forbidden. There are several different verses in Al-Quran that condemn the act of riba’.

Usury or riba’ is often associated with interest. This is because businesses make profits through the charging of interest for deferred payment. In Islam, making a profit is allowable. However, Islam does not allow making an unjust and excessive profit. Simply because it may cause harm to other people.

In fact, Islam encourages trading and selling. Sellers can make profits from selling or trading goods, but not excessively. The question is then what is excessive profits? There is no threshold on what is as riba’ or excessive profits.

2. Maisyir

Maisyir is the game of chance. Islam prohibits and forbids maisyir. This is because in such an arrangement, gain is expected merely by chance, with no risk assumed for such gain.

A common transaction or business dealing associated with the element of maisyir is gambling. In gambling, the gambler entered into such a transaction with the wishful hope of making gain out of nothing. Islam allows profits or gains. However, there must be risk or liability undertaken to justify for the profit or gain.

3. Gharar

Gharar is associated with uncertainty, hazard or risk in business dealings. Examples of common gharar element in business dealing are:

- Uncertainty from the asset ownership or possession. The assets involved in business trade must be clearly own or in the possession of the party to the transaction.

- Insufficient or inadequacy of information. For example, a business dealing where the seller will sell his house to the buyer without further information. In this case, it is uncertain which specific house is involved. As such, there is an element of gharar in this dealing.

- Interdependent or conditional contracts. For example, a buyer and seller enter into a contract which stipulates that “I will sell this car if person A transferred such car to me”. In this example, the gharar element exists because the sale of the car is dependent on the other person to transfer the car to the seller.

Our next article will introduce you to the sources of Islamic rulings and the objectives of Islamic rulings in Islamic Finance. Till then, stay tuned!