The introduction of MFRS 16 Leases (which is equivalent or word-for-word IFRS 16 Leases) has changed the way companies record their operating lease transactions in the book. As explained previously in IFRS 16 Leases – The lessee perspective, the new standard requires an entity to record all lease transactions, including the previously classified ‘operating lease’ in its book, except if an entity elects to apply practical expedient not to recognise the short term and low-value assets on adoption of the standard.

Before the introduction of the standard, entities recorded their operating lease transactions off the book (off-balance sheet) – i.e., lease payments were only recorded as an expense on a straight-line basis over the lease term when incurred (or some other systematic basis of allocation). Other than that, entities were only required to disclose some information pertaining to their non-cancellable operating lease arrangements in the financial statements, particularly on the total future minimum lease payments and sublease payments expected to be received under non-cancellable operating lease as well as a general description of the lessee’s significant leasing arrangements.

This fundamental change in the accounting for leases by the lessees allows companies that use operating lease arrangement as their mode of ‘financing’ to be compared to other companies which use normal finance/loan arrangement. In Malaysia, entities is required to apply MFRS 16 for annual reporting periods beginning on or after 1 January 2019, with early adoption permitted.

Some of our regular readers are looking to know more about the following areas:

- What is the impact on the initial application of this standard to Malaysian listed companies in Bursa Malaysia main market;

- What are the type of assets subject to operating leases arrangements by the listed companies;

- What is the weighted average lessee’s incremental borrowing rate used on the initial application of the standard; and

- What is the method adopted to report the impact on the initial application of MFRS 16.

Let’s now dive into the insights for the above questions based on our analysis of the audited financial statements of the companies as available publicly as at the date this article is written.

MFRS 16 requirements on the initial application of the standard

On initial application of MFRS 16, entities are required to recognise a right-of-use asset (“RoU asset”) and a lease liability for leases previously classified as an operating lease applying MFRS 117 Leases. The RoU asset is measured either (i) at its carrying amount as if this standard had been applied since the commencement date, discounted using the lessee’s incremental borrowing rate at the date of initial application; or (ii) an amount equal to the lease liability, adjusted for any prepaid or accrued lease payments immediately before the date of initial application.

The impact of applying the standard is adjusted retrospectively, either:

- Retrospectively to each prior reporting period presented (i.e., full retrospective method) or

- Retrospectively with the cumulative effect of initially applying the standard is recognised at the date of initial application (i.e., modified retrospective method).

The general expectation is that most (if not all) entities will present the cumulative effects of the initial application of MFRS 16 using the modified retrospective method. This method it is a simplification given in the standard to help entities to report the impact in the financial statements. Under this method, entities do not need to restate their comparative numbers – i.e., comparative numbers are based on MFRS 117 instead of MFRS 16. The full retrospective method is the normal retrospective adjustments made to the prior period numbers when entities change their accounting policy as explained in IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors – i.e., both current year and prior year numbers are prepared according to MFRS 16.

Summary of listed companies subject to this analysis

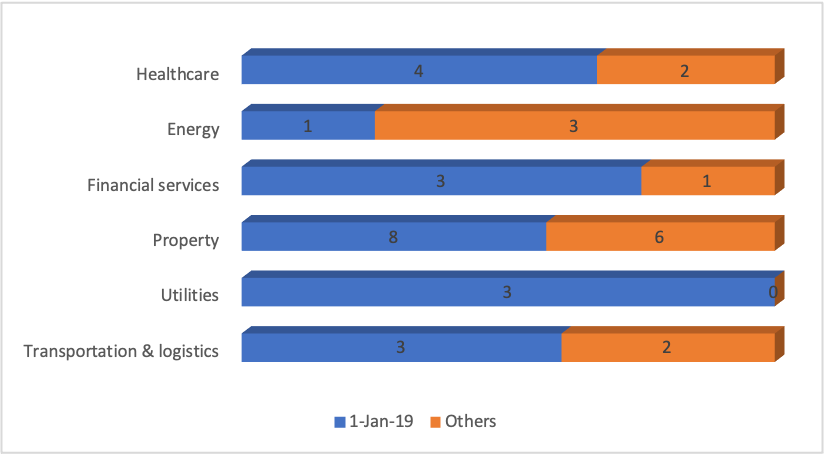

For the purpose of this article, we have analysed the publicly available audited financial statements of 36 companies listed in the main market of Bursa Malaysia in six sectors – transportation and logistics, utilities, property, financial services, energy and healthcare. Below is the summary of companies analysed by their sector and initial adoption date of MFRS 16.

Out of 36 companies, 22 companies adopted MFRS 16 for the financial period beginning on 1 January 2019. Other companies adopted MFRS 16 for the financial period beginning on 1 February 2019 (3 companies), 1 April 2019 (4 companies), 1 July 2019 (5 companies) and 1 September 2019 (1 company) – the effective date of the standard. One company, however, Bursa Malaysia Berhad, had elected to early adopt MFRS 16 much earlier before the effective date of the standard – on 1 January 2017.

Summary of analysis on the initial application of MFRS 16

Consistent with expectation (and probably the intention of the standard-setter), majority of the 36 companies – i.e., 34 companies or 94% of companies – elected the modified retrospective method to report their initial adoption effects in the financial statements. This means the cumulative effects on the initial application of MFRS 16 is only adjusted to the opening balance of retained earnings as at the date of initial application. The comparative amount was not restated and continued to be reported under the previous accounting policies governed under MFRS 117 and IC Interpretation 4 Determining whether an Arrangement Contains a Lease. The remaining 2 companies did not provide the details because the initial adoption of MFRS 16 did not have a material impact on the companies as a group.

Below is the summary of the financial impact to the 36 companies by sector on their initial application of MFRS 16. For this analysis, the impact for the 36 companies is observed as a group. In addition, the reclassification impact is also not included– i.e., reclass from one category of an asset to another – as this has no bearing or impact on the companies’ retained earnings on the initial application of MFRS 16.

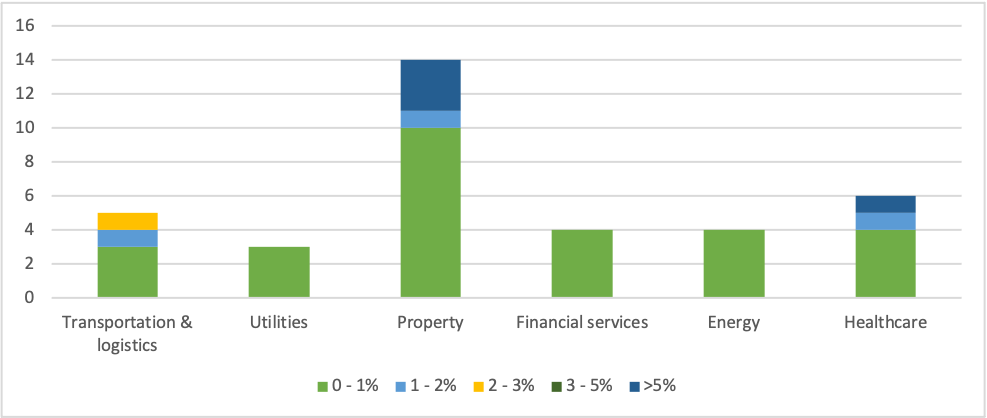

Out of the 36 companies, 28 companies or 78% of the companies reported an increase in consolidated total assets of 1% or less on the initial adoption of MFRS 16. Interestingly, one company in the property sector recorded an increase as high as 33% of its consolidated total assets and one company in healthcare sector recorded an increase of 18% of its consolidated total assets. The significant increase in the consolidated total assets for these 2 companies arisen from their leasing arrangement for land and buildings.

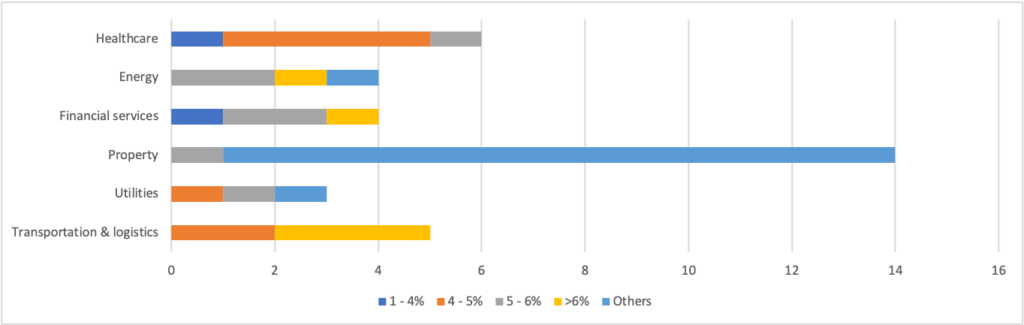

Another aspect observed is the weighted average incremental borrowing rate applied to lease liabilities recognised in the statement of financial position at the date of initial application of MFRS 16. Incremental borrowing rate reflects the rate of interest the company or group would have to pay to borrow over a similar term, and with similar security, the funds necessary to obtain an asset of similar value to the RoU asset in a similar economic environment. Below is the summary of the weighted average incremental borrowing rate applied by these 36 companies in the 6 sectors:

4 out of 6 companies in the healthcare sector had a weighted average incremental borrowing rate between 4% to 5% and one company each had a rate between 1% to 4% and 5% to 6%.

For the transportation and logistics sector, 3 companies had a weighted average incremental borrowing rate of more than 6% and the remaining 2 companies had a weighted average incremental borrowing rate between 4% to 5%. The highest weighted average incremental borrowing rate applied for this sector was 13%.

As for the financial services sector, 50% of the companies had the weighted average incremental borrowing rate of 5% to 6% and one company each between 1% to 4% and more than 6%.

About 50% of companies in the energy sector also had the weighted average incremental borrowing rate between 5% to 6%, one company had more than 6% and the remaining 1 company did not provide information in this regard. The highest weighted average incremental borrowing rate applied was 11.8% for this sector.

As for the utilities sector, one company had the weighted average incremental borrowing rate between 4% to 5%, one company between 5% to 6% and the remaining one company did not provide information on the rate applied.

For the property sector, one company applied the weighted average incremental borrowing rate between 5% to 6%. As for the ‘others’ category in the property sector, the details are as follows:

- Two companies provided a range for the weighted average incremental borrowing rate applied where one company applied the weighted average incremental borrowing rate between 5.1% to 7.8% and another company applied a rate between 5.65% to 7.5%;

- Four companies did not disclose their weighted average incremental borrowing rate applied; and

- Seven companies did not provide this information because either MFRS 16 has no significant impact on their financial statements, the initial application only involves a reclassification adjustment, assets were fully impaired on the initial application or their previously classified operating lease arrangements were short-term leases.

From our analysis of the publicly available audited financial statements, the cumulative effects of the initial application of MFRS 16 generally arise from the lease of office buildings, factory building, leasehold land and motor vehicles.

The above analysis summarises the impact on the initial application of MFRS 16 for Malaysian listed entities in the main market for the 6 sectors. Although some companies did not disclose certain information as required by the standard on the initial application of MFRS 16, most of the companies generally provided sufficiently clear information on their MFRS 16 initial application effects.

Stay tuned for our upcoming articles by following us on social media. Meantime, enjoy other articles in Financial Accounting section or ask your queries by Joining us on Community. It is free and open to join for all, now.