IFRS Interpretation Committee (“IFRIC”) had issued an addendum on 27 April 2021 to summarise IFRIC consideration and decision relating to the configuration and customisation costs in a cloud computing arrangement. This addendum follows the initial discussion on the same issue in its IFRIC Update in March 2021. The issue submitted to IFRIC is on how a customer should account for the costs of configuring or customising the supplier’s software in a Software as a Service arrangement (“SaaS”).

Let’s now go into the details of the issues.

What is the issue for the configuration or customisation costs in a cloud computing arrangement?

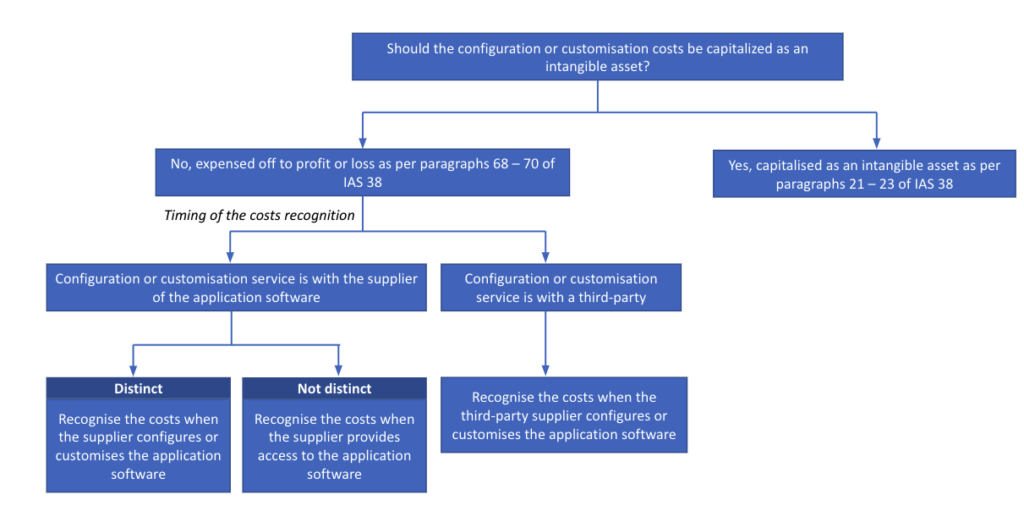

In analysing the issue of how to account for the costs of configuring or customising the supplier’s software in SaaS, the main consideration is whether such costs should be capitalised as an intangible asset.

In the issue submitted, the submitter provided the following fact pattern for IFRIC consideration:

- The customer enters into a SaaS arrangement with the supplier whereby the customer obtains the right to receive access to the supplier’s application software. Such a right does not provide the customer with a software asset and accordingly, the customer only receives the service to access the software over the contract period.

- The customer incurs costs of configuring or customising the application software to be able to obtain the benefits from such access. The configuration or customisation was described by the submitter as follows:

- configuration involves the setting of various ‘flags’ or ‘switches’ within the application software or defining values or parameters, to set up the software’s existing code to function in a specified way.

- customisation involves modifying the software code in the application or writing additional code. Customisation generally changes or creates additional functionalities within the software.

- The customer also did not receive any other goods or services.

What is the IFRIC view on how to account for the configuration or customisation costs?

IFRIC observed that based on the SaaS arrangement described by the submitter, the customer would often not recognise an intangible asset. This is because based on the fact pattern submitted, the configuration or customisation services do not meet the recognition criteria of an intangible asset as:

- the supplier controls the application software to which the customer has access, and

- the configuration or customisation activities do not create a resource controlled by the customer that is separate from the software.

So, then, the next question is how the cost should be accounted for. IFRIC further observed that the customer recognises the costs as an expense in the book. IFRIC refers to the guidance available in IAS 38 Intangible Assets with regard to the timing for the recognition of such costs. Paragraph 69 of IAS 38 states that the customer should recognise such costs when it receives the services (in a contract for the supply of service) or when it has a right to access the goods (in a contract for the supply of goods).

Paragraph 69A further states that services are received when they are performed by the supplier as per the contract. IAS 38 however, falls short in providing further guidance on the identification of the services the customer receives to determine when the supplier performs those services. Because of this, the IFRIC agenda decision suggests for the customer to apply the guidance in IFRS 15 Revenue from Contracts with Customers using the IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors hierarchy. This means the customer is put into the same consideration as the supplier when the supplier wants to identify the promised goods and services in a contract with a customer. Particularly, this IFRIC agenda decision requires the customer to determine whether the services that the customer receives are distinct, if the contract to deliver the configuration or customisation services is with the supplier of the application software.

- If the services are distinct – the customer recognises the costs as an expense when the supplier configures or customises the application software.

- If the services are not distinct – the customer recognises the costs as an expense when the supplier provides access to the application software over the contract period.

However, if the delivery of the configuration or customisation services is with a third-party supplier, the customer recognises the costs as an expense when the third-party supplier configures or customises the application software.

The summary of the IFRIC Agenda Decision: Configuration or Customisation Costs in a Cloud Computing Arrangement (IAS 38 Intangible Assets) is as follows:

Other additional aspects included in the agenda decision are as follows:

- Recognition of prepayment as an asset when the customer pays the supplier of the configuration or customisation services before receiving those services.

- Consider appropriate disclosure of its accounting policy for configuration or customisation costs if such disclosure is relevant to the understanding of the users of the financial statements.

- In some circumstances, it is possible for a customer to recognise an intangible asset when the customer has the power to obtain future economic benefits and restrict others to access the benefits, for example, the additional code in the configuration or customisation activities. This again requires the customer to assess and determine whether it meets the recognition criteria.

The full agenda decision is available on the IASB’s website – Compilation of Agenda Decisions published by IFRIC (Volume 4) for your reference. Although this is just an agenda decision, it plays an important role and gives a significant impact on entities whose accounting policy is different from the agenda decision. We have covered the discussion on the role of IFRIC agenda decision in IFRIC Agenda Decision: How does it affect you? We will catch up with you again in our upcoming articles. In the meantime, please enjoy other related articles in the Financial Accounting section.